IRS tax forms

Internal Revenue Service tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. They are used to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code. There are over 800 various forms and schedules. Other tax forms in …

How to report donations to charity to IRS?

Mar 23, 2022 · Bank records or a written communication for cash donations. Form 8283 for non-cash deductions; Federal Tax Deductions for Small Business Charitable Donations. Small businesses can receive a tax deduction for making charitable donation. The IRS has specific reporting requirements when a small business donates: Non-food inventory ; Food; Intellectual …

How to make sure your charity donation is tax deductible?

Feb 18, 2022 · You must fill out one or more Forms 8283, Noncash Charitable Contributions and attach them to your return, if your deduction for each noncash contribution is more than $500. If you claim a deduction of more than $500, but not more than $5,000 per item (or a group of similar items), you must fill out Form 8283, Section A.

What are the tax breaks for donating to charity?

Jul 20, 2021 · Charitable Contributions. A searchable database of organizations eligible to receive tax-deductible charitable contributions. Amount and types of deductible contributions, what records to keep and how to report contributions. How donors, charities, and tax professionals must report non-cash charitable contributions.

Does the government tax our donations to charity?

May 04, 2020 · If you are a sole proprietor, your business taxes are filed on Schedule C of your personal Form 1040. Your business cannot make separate charitable contributions because the only way individuals can deduct these contributions is on Schedule A.

What tax form do I use for charitable donations?

Form 8283More In Forms and Instructions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.Feb 8, 2022

Can you claim charitable donations as a business expense?

Taxpayers must remember that a payment to a charitable organization won't be deductible as a business expense unless it's clearly shown that the contribution was made in the furtherance of business purposes, and was not a mere gift.

Can an LLC write off charitable donations?

The Internal Revenue Service requires LLCs to file as a partnership, a corporation or an S corporation. An LLC can make charitable contributions as long as the beneficiary qualifies under IRS regulations and the LLC accounts properly for the donations.

Do you need proof of charitable donations for taxes?

For any contribution of $250 or more (including contributions of cash or property), you must obtain and keep in your records a contemporaneous written acknowledgment from the qualified organization indicating the amount of the cash and a description of any property contributed.

Can a business write off cash donations?

The IRS allows for both cash and non-cash donations, like goods, inventory, and property from businesses. Cash and check donations must have proof of the donation to be deductible. You may be able to deduct expenses for volunteering at a qualified service project or charitable event.

How much can you donate to charity and not get audited?

Non-Cash Contributions Donating non-cash items to a charity will raise an audit flag if the value exceeds the $500 threshold for Form 8283, which the IRS always puts under close scrutiny. If you fail to value the donated item correctly, the IRS may deny your entire deduction, even if you underestimate the value.

Can you take charitable donations without itemizing in 2021?

Single taxpayers can claim a tax write-off for cash charitable gifts up to $300 and married couples filing together may get up to $600 for 2021. The tax break is available even if you claim the standard deduction and don't itemize.Mar 2, 2022

Can you take charitable donations without itemizing in 2020?

Even if you don't itemize your taxes, you can still deduct for some charitable donations. You can get a tax break for this year's contributions to nonprofits and charities even if you don't itemize your taxes next year.Dec 28, 2021

How much does charitable donation reduce taxes?

60%When you donate cash to a public charity, you can generally deduct up to 60% of your adjusted gross income.

How does IRS verify charitable donations?

The IRS reminds taxpayers to make sure they're donating to a recognized charity. To receive a deduction, taxpayers must donate to a qualified charity. To check the status of a charity, they can use the IRS Tax Exempt Organization Search tool. Cash contributions to most charitable organizations qualify.Nov 3, 2021

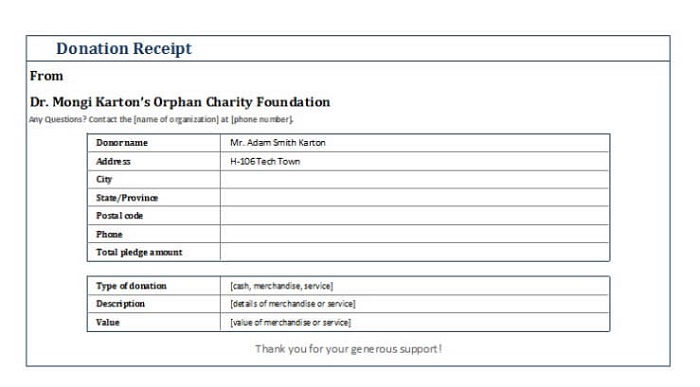

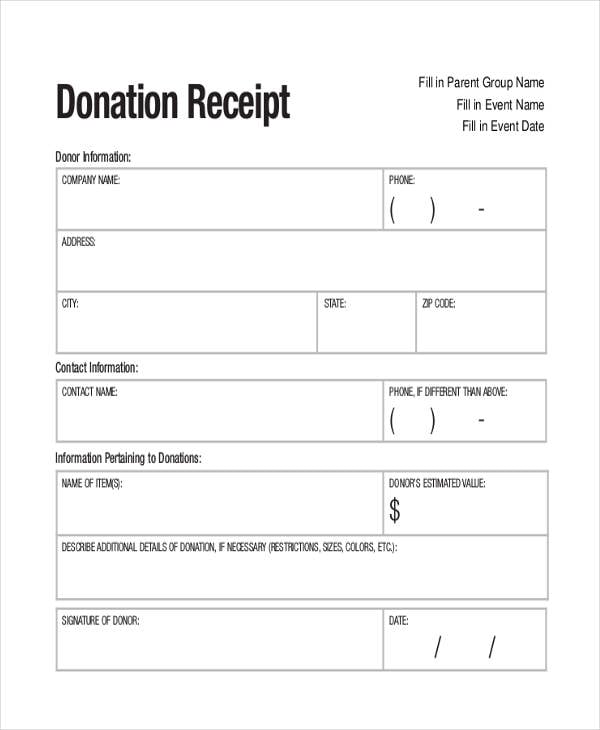

How do I prove cash donations?

A few accepted ways to show proof include a letter from the charity, a canceled check, or a credit card receipt. The donation record must show the name of the organization, the amount, and the date that the donation was made. The IRS also has a full list of qualifying records for your tax return.Jan 4, 2022

How to deduct charitable donations?

1. Donate to a qualifying organization 1 Your charitable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by section 501 (c) (3) of the Internal Revenue Code. Examples of qualified institutions include religious organizations, the Red Cross, nonprofit educational agencies, museums, volunteer fire companies and organizations that maintain public parks. 2 An organization can be nonprofit without 501 (c) (3) status, which can make it tricky to ensure your charity of choice counts. 3 You can verify an organization’s status with the IRS Exempt Organizations Select Check tool. 4 Before you donate, ask the charity how much of your contribution will be tax-deductible.

What is tax deductible donation?

Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Tax deductible donations can reduce taxable income. To claim tax deductible donations on your taxes, you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. For the 2020 tax year, there's a twist: you can deduct ...

How much can you deduct on your taxes for 2020?

For the 2020 tax year, you can deduct up to $300 of cash donations on a tax return without having to itemize. This is called an "above the line" deduction.

Can you deduct volunteer time?

IRS rules don’t let you deduct the value of your time or service, but expenses related to volunteering for a qualified organization can be tax deductible donations. Expenses must be directly and solely connected to the volunteer work you did; not previously reimbursed; and not personal, living, or family expenses.

Can you itemize a standard deduction?

Itemizing can take more time than if you just take the standard deduction, and it may require more expensive tax software or create a higher bill from your tax preparer. Plus, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to abandon itemizing and take the standard deduction instead. ...

What is 30% charitable deduction?

The 30% rule applies to private foundations that don't fall under the 50% rule. Again, the details of charitable tax deductions can get a little tricky. It's helpful to know your business's net gross income and to speak with a tax professional.

How to make the most out of your donations?

To make the most out of your donations, first of all, pick the right organization to donate to. For a small business that's tied to the community, it often makes sense to pick a local group.

How does a donor advised fund work?

A donor-advised fund allows you to donate enough money upfront in one year to become eligible for tax deductions while the donor-advised fund holds on to the money.

Why do people donate to charities?

Donate to charity because you feel a connection to an organization, not because you want a tax deduction. There's more to charitable giving than receiving tax benefits. When it comes to the paperwork and tax requirements for charitable contributions, it's often easiest to speak with a tax advisor. As summer closes and the holiday season draws ...

Why is charitable giving important?

Charitable giving demonstrates that you give back to the community and are in business for more than profit. As a small business, while you don't get as large a tax deduction as big corporations and enterprises do, don't overlook the other benefits of philanthropy. "As a single-store retailer, it is important for us to give back to ...

Can you deduct a gift to a charity?

If you want a charity tax deduction, make sure you're donating to a charity approved by the IRS. Obviously, you won't receive a charity tax deduction if you aren't donating to an approved charity.

Why is company culture important?

Company culture is important to future and current staff, and your workers will feel good about working for a company that gives back.

What is a record of a contribution?

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.

Can you deduct a charity ball?

If you receive a benefit in exchange for the contribution such as merchandise, goods or services, including admission to a charity ball, banquet, theatrical performance, or sporting event, you can only deduct the amount that exceeds the fair market value of the benefit received or expected to be received. For contributions of cash, check, ...

Can you deduct 506 from your taxes?

Topic No. 506 Charitable Contributions. Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. However, for 2020, individuals who do not itemize their deductions may deduct up to $300 from gross income for their qualified cash charitable contributions to public charities, ...

How much can you deduct for charitable contributions?

Your deduction for charitable contributions generally can't be more than 60% of your adjusted gross income (AGI), but in some cases, 20%, 30%, or 50% limits may apply. 2 .

Why is a partnership a special case?

A partnership is a special case because the partnership itself does not pay income taxes. The income and expenses, including deductions for charitable contributions, are passed along to the partners on their individual Schedule K-1 forms each year.

Can I deduct donations to charities?

The new tax law has made some changes to your ability to deduct donations to charities on your income tax return beginning in 2018. Corporations and S corporations may still deduct charitable deductions, but other businesses may not. If your business is a sole proprietorship, partnership, or LLC, your business income is passed through ...

Do you have to itemize charitable deductions?

This means that individual taxpayers, including the owners of small businesses that pay business taxes through their personal tax returns must itemize the charitable deductions in the hope of getting above the standard deduction amount. In addition, the IRS has changed the maximum deduction based on percentage of income.

Can I claim a donation to a charity?

If you are considering giving a donation to a charity, as an individual or a business, be sure you can claim the deduction. The organization must be qualified by the IRS, either because it is a church or because it applied to the IRS. 3

Can a corporation deduct charitable donations?

How you deduct charitable contributions depends on your business type: Corporations and S corporations can make charitable donations on their business income tax returns. All other businesses pay taxes as pass-through entities. That is, the taxes of the business are passed through to the individual owners on their personal tax returns.

Can you deduct cash donations?

You may be able to deduct cash payments to an organization (charitable or otherwise) if the payments are not charitable contributions or gifts and are directly related to your business. If the payments are charitable contributions or gifts, you can't deduct them as business expenses. 4 .

Popular Posts:

- 1. where to donate old tv near me

- 2. where can i donate a mattress near me

- 3. where to donate large tv

- 4. where to donate for bronx fire

- 5. where can i donate linens

- 6. who cannot donate blood in australia

- 7. why can't grocery stores donate food

- 8. where to donate a testicle and get paid

- 9. how to donate blood to a specific person

- 10. how to donate to hurricane ida victims