What does goodwill do besides take donations?

Perhaps you are moving, or maybe you just needed to make some room and simplify your life. Whatever the reason, you've done the hard part — donating your items to Goodwill is easy. Simply load up your donations and head to a Goodwill Store & Donation Center in the Southeastern Wisconsin & Metropolitan Chicago territory. When you arrive you will see signs directing you to …

Is goodwill a bad charity?

Nov 23, 2012 · If you are certain you wish to channel your donation through goodwill, then you would do well to give the following steps a try so that you will be guided properly. Goodwill can often be quite strict on some matters pertaining to the donation of furniture. Decide what furniture you have that you no longer feel as if you have a use for and wish to donate to Goodwill. If you …

Do goodwill pay you for donations?

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of the item when new and its age must be considered. The IRS requires an item to be in good condition or better to take a …

How to contact goodwill to pick up donation?

How to fill out a Goodwill Donation Tax Receipt A: Date, Name and Address. This section organizes when a donation was made, who dropped off the donation and your... B: Donation Details. Use this area to write in a brief summary of items donated & the number of boxes and bags. The... C: Tax Year. ...

What can you donate to Goodwill Massachusetts?

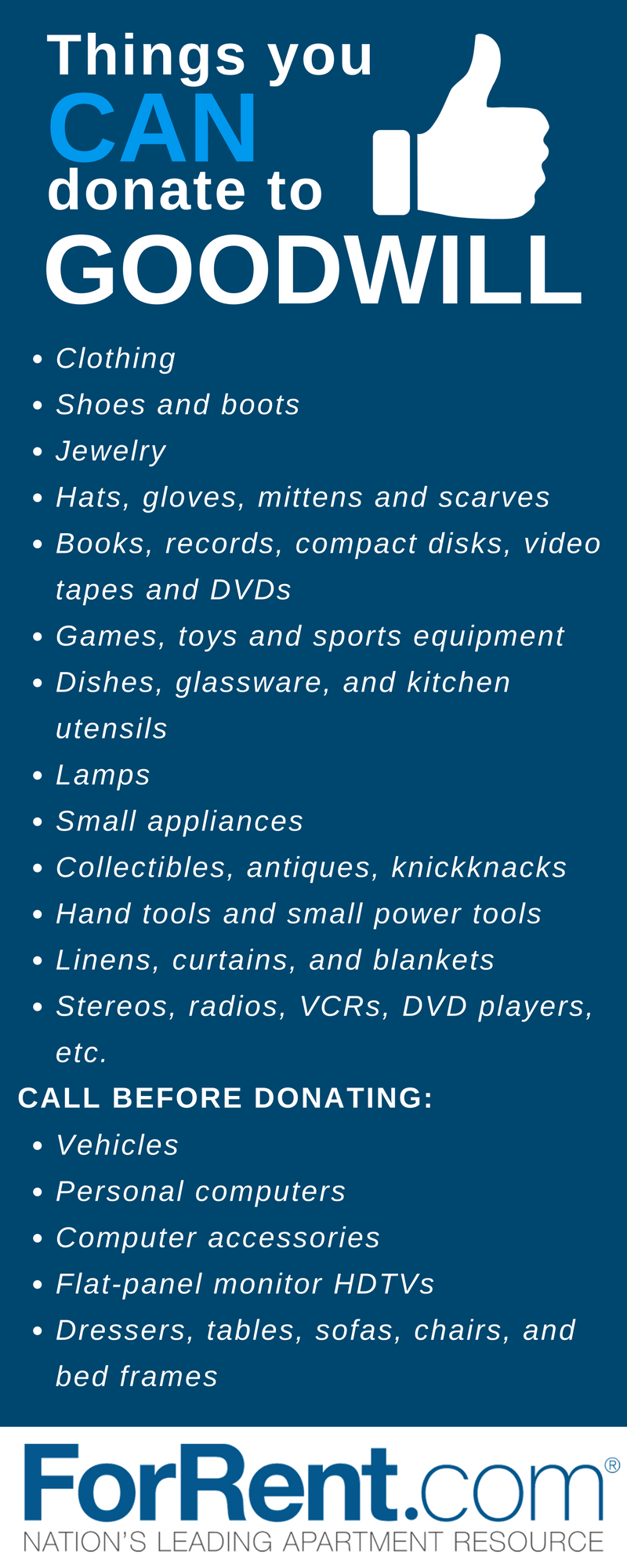

Please donate clothing; shoes; accessories including belts, handbags, hats, jewelry, and scarves; backpacks; bags; luggage; cookware including bakeware, dishes, glassware, pots, and pans; small electronics including alarm clocks, coffee pots, and toaster ovens; and home electronics including computers, laptops, stereo ...

Is Goodwill accepting donations Minnesota?

Donations can be made at any Goodwill store drive-thru during open store hours. We do not have a pick up service.

Is goodwill in California accepting donations?

Goodwill Southern California gratefully accepts donations at more than 80 retail stores and over 40 donation centers where an attendant will happily assist you by unloading your items and providing you with a receipt for your records. We are sorry for any inconvenience; however, we do not offer pick-up service.

Does goodwill take TVS California?

Electronics Accepted Goodwill accepts all types of electronics such as televisions, cell phones, computers, laptops, monitors, printers, tablets, video game consoles and more! However, we do not accept light bulbs or items with broken or cracked screens. Large household appliances may only be donated at our Outlets.

Is Goodwill taking donations in Pennsylvania?

Goodwill accepts donations of gently used clothing, household items and furniture. However, we are unable to provide home pick up service. Donations can be made at our stores and donation centers.

Does goodwill take couches California?

We do not accept large furniture. Couches, sofas, futons. Cribs, strollers, car seats, safety gates, etc. (Reason? Government safety recalls.)

Things to consider in donating furniture to goodwill

Your donation is generally for any person in their recipient list and most of them are truly in need of these things. So, when you are looking to give a donation, be certain that it can readily be beneficial to the person receiving it and will not cause any problem in their lives.

Knowing some steps in donating

If you are certain you wish to channel your donation through goodwill, then you would do well to give the following steps a try so that you will be guided properly. Goodwill can often be quite strict on some matters pertaining to the donation of furniture.

What is Tax Deductible?

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of the item when new and its age must be considered

Donation Receipts

We can provide donation receipts to document the value of your donation. When making a donation to Goodwill, ask the sales associate for a receipt.

A: Date, Name and Address

This section organizes when a donation was made, who dropped off the donation and your current address.

B: Donation Details

Use this area to write in a brief summary of items donated & the number of boxes and bags. The “Other” section can be used to describe items that are not clothing, household or furniture. Examples: computer equipment or automobiles.

D: Tax Receipt Value

Write in the total fair market value of your donation. This value is determined by you, the donor. Goodwill provides a donation value guide to help determine fair market value. Please note: Goodwill employees cannot help determine fair market value.

F: Goodwill Confirmation

Tax receipts need to be signed by the employee that accepted the donation.

Does Goodwill need donations?

While the Goodwill is a charity that helps people, they still need funding. Most of their funding comes from drop off donations. Goodwill is primarily funded by their thrift stores. They receive donations from supporting parties, but their thrift stores make up the bulk of their financial backing.

Does Goodwill pay taxes?

This simply means that Goodwill is a tax-exempt group that doesn’t pay income taxes on the donation money they receive or the items given to their charity. They also work to help disenfranchised and poverty-stricken people. While the Goodwill is a charity that helps people, they still need funding.

Popular Posts:

- 1. how much tax return if i donate my car

- 2. how to get places to donate free turkeys and hams for the less fortunate

- 3. what vaccine did dolly donate to

- 4. how to find a good charity to donate to

- 5. percentage of alumni who donate from webster university

- 6. how to donate clothes to women's shelter

- 7. how to donate to ky tornado victims

- 8. why did andrew carnegie donate his money

- 9. where to donate sports equipment

- 10. how to donate cell phones