How much charitable giving is tax deductible?

Aug 25, 2021 · Cash donations are deductible up to a limit of 60% of your AGI. Non-cash donations. The deductible limit for non-cash donations falls between 20% and 50% of your AGI, depending on the type of non-cash donation that's being made.

How much will charitable donations lower my taxes?

If you want to claim that the object you donate to charity is worth, for instance, $5,000, you will need to get a written appraisal from a qualified person to establish the true value of the donation. For the 2010 tax year, if the value of your donation is above $20,000 but below $50,000, you will need to submit a written appraisal of the value of the object together with a detailed …

What donations are tax deductible?

Mar 30, 2017 · The IRS limits the maximum you can deduct from your taxes for charitable donations to 50 percent of your adjusted gross income for the year. If you donate the furniture to a 30 percent limit ...

How much charitable donations are deductible?

Tax information. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

Are All Donations Tax Deductible?

No. The IRS only allows you to deduct donations from your taxable income if the donation was made to a qualified tax-exempt organization. 501(c)(3)...

What Is The Maximum Charitable Donation Limit Per Year?

This is where things get a bit tricky. There are maximum IRS charitable donation amounts, but they are a percentage and not a defined dollar amount...

What If You Donate More Than The IRS Limit? Can You Carry Over Donations to Future years?

Yes. You can carry over deductions from any year in which you surpass the IRS charitable donation deduction limits, up to a maximum of 5 years. The...

What Proof Do You Need to Claim A Charitable Donation?

By default, always at least get written confirmation. I won’t get in to the full details here, since I have previously gone in to depth about cash...

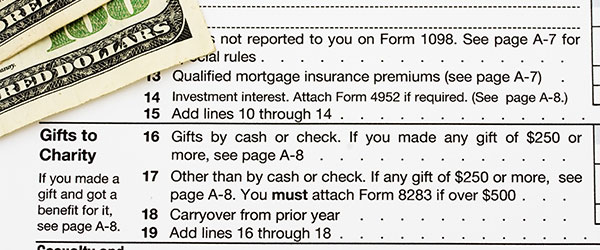

Can You Deduct Charitable Contributions If You Don’T Itemize Your Taxes?

In order to deduct a charitable contribution, you must itemize your taxes. THIS. IS. HUGE.Less than 40% of American taxpayers itemize their taxes,...

The Republican Tax Reform Impact on Charitable Deductions

I wrote about this at length, but the Republican “Tax Cuts and Jobs Act” (aka “Republican tax reform” will create a charitable donation deduction c...

How much can you deduct from your AGI?

Cash donations are deductible up to a limit of 60% of your AGI. Non-cash donations. The deductible limit for non-cash donations falls between 20% and 50% of your AGI, depending on the type of non-cash donation that's being made.

Is a donation to a religious organization tax deductible?

To be deductible, your donation must be made to a tax-exempt organization—also known as a 501 (c) (3)—such as a religious organization, nonprofit hospital or school, scientific organization, or service organization.

Can you deduct charitable donations?

Your ability to deduct charitable gifts depends on the type of donations you make and the organizations receiving them. If you make charitable donations within any given tax year, you may be able to take a tax deduction for your charitable giving. The available deduction depends on whether you're making a cash donation or a non-cash donation, ...

Can you deduct volunteer expenses?

Note that while you can't deduct the value of services you volunteer to a qualified organization, you can deduct the expenses you incur in performing those volunteer services. The deduction for these out-of-pocket expenses is subject to the limit that applies to donations made to the organization.

How much can you deduct for charitable donations?

The amount you can deduct for charitable contributions generally is limited to no more than 60% of your adjusted gross income. Your deduction may be further limited to 50%, 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type of organization you give it to. See that form and the instructions in the ...

How much can you deduct from your taxes in 2020?

Those who itemize taxes can deduct up to 100% of adjusted gross income in 2020.

How much can you deduct from your AGI?

In practical terms, at a minimum, you will be able to deduct 20% of your AGI. At a maximum, you will be able to deduct 60%. If your donation totals less than 20% of your AGI (the case for the overwhelming majority of people), then don’t worry about all of the details. Deduct and move on.

What is the impact of the Republican tax reform?

The Republican Tax Reform Impact on Charitable Deductions. I wrote about this at length, but the Republican “Tax Cuts and Jobs Act” (aka “Republican tax reform” will create a charitable donation deduction crash, because the standard deduction was increased in 2018.

What is the standard deduction for 2021?

$24,800 for married filing jointly. $18,650 for head of household. 2021: $12,550 for single filers. $12,550 for married, filing separately.

Can you deduct donations from your taxes?

No. The IRS only allows you to deduct donations from your taxable income if the donation was made to a qualified tax-exempt organization. 501 (c) (3) organizations are included, but other types of orgs are as well. Make sure you do your research to determine if the organization is tax exempt.

Can you carry over a donation to a future year?

Can you Carry Over Donations to Future Years? Yes. You can carry over deductions from any year in which you surpass the IRS charitable donation deduction limits, up to a maximum of 5 years. The same percentage limits discussed earlier apply to the year that you carry over the donation amounts to.

How much can you deduct from charitable donations?

Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax Exempt Organization Search uses deductibility status codes to identify these ...

What percentage of charitable contributions can you deduct on Schedule A?

In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (AGI). Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent ...

How much can I deduct for food inventory?

There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the taxpayer’s aggregate net income or taxable income. For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

How much of your food inventory can you deduct in 2020?

For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

What is tax exempt organization search?

The organizations listed in Tax Exempt Organization Search with foreign addresses are generally not foreign organizations but are domestically formed organizations carrying on activities in foreign countries. These organizations are treated the same as any other domestic organization with regard to deductibility limitations.

Can you deduct a donation of cash?

Deductible Amounts. If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made.

Can I deduct contributions to a Canadian organization?

A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax return, as described in Publication 597 PDF. Except as indicated above, contributions to a foreign organization are not deductible.

How to deduct a charitable donation?

Once you've decided to give to charity, consider these steps if you plan to take your charitable deduction: 1 Make sure the non-profit organization is a 501 (c) (3) public charity or private foundation. 2 Keep a record of the contribution (usually the tax receipt from the charity). 3 If it's a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you're claiming. 4 With your paperwork ready, itemize your deductions and file your tax return.

How much can you deduct from your charitable contribution in 2021?

When you make a charitable contribution of cash to a qualifying public charity, in 2021, under the Consolidated Appropriations Act 1, you can deduct up to 100% of your adjusted gross income.

What is the Pease limitation?

The Pease limitation was an overall reduction on itemized deductions for higher-income taxpayers. The rule reduced the value of a taxpayer’s itemized deductions by 3% of adjusted gross income (AGI) over a certain threshold.

What is the purpose of charitable deductions?

The purpose of charitable tax deductions are to reduce your taxable income and your tax bill —and in this case, improving the world while you’re at it. 1.

What is marginal tax rate?

In essence, the marginal tax rate is the percentage taken from your next dollar of taxable income above a pre-defined income threshold. That means each taxpayer is technically in several income tax brackets, but the term “tax bracket” refers to your top tax rate.

What is the federal tax bracket?

Federal tax brackets are based on taxable income and filing status. Each taxpayer belongs to a designated tax bracket, but it’s a tiered system. For example, a portion of your income is taxed at 12%, the next portion is taxed at 22%, and so on. This is referred to as the marginal tax rate, meaning the percentage of tax applied to your income ...

What are the most common expenses that qualify for a standard deduction?

The most common expenses that qualify are: Mortgage interest. State and local tax. Charitable giving. Medical and dental expenses.

How to avoid IRS problems?

To avoid problems with the IRS, you should keep accurate records of your donations, get proper receipts for all your donations and value your donations according to the rules set by the IRS. When requesting documentation from a beneficiary, make sure that all documents bear the official letterhead of the beneficiary organization. Also, you should see to it that you write off all your charitable deductions during the same year when you made them.

Can donations be made in cash?

Donations may be made in cash or in terms of merchandise and property. Based on the guidelines set by the IRS, for tax purposes, goods, merchandise and property donated should be valued based on their currently estimated value.

What percentage of your adjusted gross income can you deduct for furniture donations?

If you donate the furniture to a 30 percent limit organization, your deduction can't exceed 30 percent of your adjusted gross income. These organizations include veterans' groups, nonprofit cemeteries and fraternal groups.

Where is Mike from The Motley Fool?

Based in the Kansas City area , Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by "Quicken," "TurboTax," and "The Motley Fool."

Is furniture considered personal property?

Furniture counts as tangible personal property, so you also have to reduce the fair market value by any long-term gains if the charity doesn't use the furniture itself. For example, if you donate the furniture to a charity that sells it to raise money, you're limited to deducting what you paid for the furniture.

Can you write off the fair market value of furniture?

The general rule for furniture donations is that you can write off the fair market value of the furniture. The Internal Revenue Service doesn't give specific values for figuring fair market value, but rather says it's the price that a willing seller would offer and a willing buyer would pay.

Can you get a deduction for donating furniture?

However, when you itemize, you give up the standard deduction. Your itemized deductions, including your furniture donation, should exceed your standard deduction. If you don't itemize, you won't get any tax deduction for donating your furniture.

What can you deduct from your taxes?

According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them.

Can a charity tell you what your donation is worth?

Value usually depends on the condition of the item. By law, a charity cannot tell you what your donated items are worth. This is something you must do yourself. To assess “fair market value” for your donations: Consult a local tax advisor who should be familiar with market values in your region.

Do charitable donations have to be itemized?

The Internal Revenue Service requires that all charitable donations be itemized and valued. Use the list of average prices below as a guide for determining the value of your donation. Values are approximate and are based on items in good condition.

How to write off food donations?

To write off your food donation, you have to itemize your deduction with Schedule A of the IRS 1040 tax form. Depending on your other itemized deductions, it might not be worth giving up your standard deduction to claim your food donation. If you do want to itemize, you report your food donation, along with any other property donations, ...

What do you need to do when you make a donation?

When you make the donation, you need to get a receipt from the charity documenting your donation. The receipt should have the name of the charity, the date of the donation, a description of what you donated and whether you received anything in return for your donation. If you make a donation of less than $250 and getting a receipt is impractical -- ...

What are qualified charities?

Qualified charities typically include religious organizations, nonprofit charitable organizations and nonprofit hospitals. If you're not sure if an organization qualifies, you can check the IRS online database. If you make the donation to a non-qualified organization or an individual, no matter how needy that person is, ...

How much can you deduct for spaghetti?

For example, if you find a really great sale on spaghetti so you can buy it for 25 cents per pound when it usually costs $1.50, unless you hold that spaghetti for a year, you're limited to deducting 25 cents per pound.

Where is Mike from The Motley Fool?

Based in the Kansas City area , Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by "Quicken," "TurboTax," and "The Motley Fool."

Can you write off a donation to a charity?

Naturally, you can also write off a cash donation you make to a charity to help it meet its food expenses or any other costs. When you make a donation of food, you usually have to deduct only the price that you paid for it. You can only include gains on what you paid for it if the gain would be long-term capital gains, ...

Is a donation to a charity tax deductible?

Charitable donations are generally tax deductible, assuming you're giving to a charity approved for tax exemption by the IRS. Knowing the rules ahead of time helps you plan your donations to maximize your deductions.

Temporary Suspension of Limits on Charitable Contributions

- In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (AGI). Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporatio…

Temporary Increase in Limits on Contributions of Food Inventory

- There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the taxpayer’s aggregate net income or taxable income. For contributions of food inv…

Qualified Organizations

- You may deduct a charitable contribution made to, or for the use of, any of the following organizations that otherwise are qualified under section 170(c) of the Internal Revenue Code: 1. A state or United States possession (or political subdivision thereof), or the United States or the District of Columbia, if made exclusively for public purposes; 2. A community chest, corporation…

Timing of Contributions

- Contributions must actually be paid in cash or other property before the close of your tax year to be deductible, whether you use the cash or accrual method.

Deductible Amounts

- If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made. The rules relating to how to determine fair market value are discussed in Publication 561, Determining the Value of Donated Property PDF.

Limitations on Deductions

- In general, contributions to charitable organizations may be deducted up to 50 percent of adjusted gross income computed without regard to net operating loss carrybacks. Contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (computed without regard to net operating loss car…

Foreign Organizations

- The organizations listed in Tax Exempt Organization Search with foreign addresses are generally not foreign organizationsbut are domestically formed organizations carrying on activities in foreign countries. These organizations are treated the same as any other domestic organization with regard to deductibility limitations. Certain organizations with Canadian addresses listed ma…

Reliance on Tax Exempt Organization Search

- Revenue Procedure 2011-33, 2011-25 I.R.B. 887 describes the extent to which grantors and contributors may rely on the listing of an organization in electronic Publication 78 and the IRS Business Master File extract) in determining the deductibility of contributions to such organization. Grantors and contributors may continue to rely on the Pub.78 data contained in Ta…

Popular Posts:

- 1. how to donate yoyr body to science

- 2. which charity to donate to

- 3. where to donate magazines to soldiers

- 4. how to donate to deborah hospital in nj

- 5. what is the best way to donate to puerto rico?

- 6. how much does charity miles donate per mile

- 7. how much did kevin chou donate to uc berkeley

- 8. how much does scholastic donate to classroom with purchase

- 9. how long do i have to grow my hair to donate it

- 10. where can i donate a car seat near me