What is the maximum tax deduction for goodwill?

3 rows · Feb 09, 2022 · For the 2021 tax year, you can deduct up to $300 of cash donations per person without having to ...

What is tax deduction for donated items?

Jan 31, 2022 · You wont get access to the tax benefits of donating to a nonprofit if you take the standard deduction unless the IRS makes an exception for a specific tax year. For example, …

Is donating clothes tax deductible?

Jan 13, 2022 · If you contribute $250 or more, be sure to get a statement from the charity acknowledging your gift, the date and amount of your donation, and confirmation that you did …

Are donations to Goodwill deductible?

3 rows · When you donate cash to a public charity, you can generally deduct up to 60% of your adjusted ...

How to deduct a charitable donation?

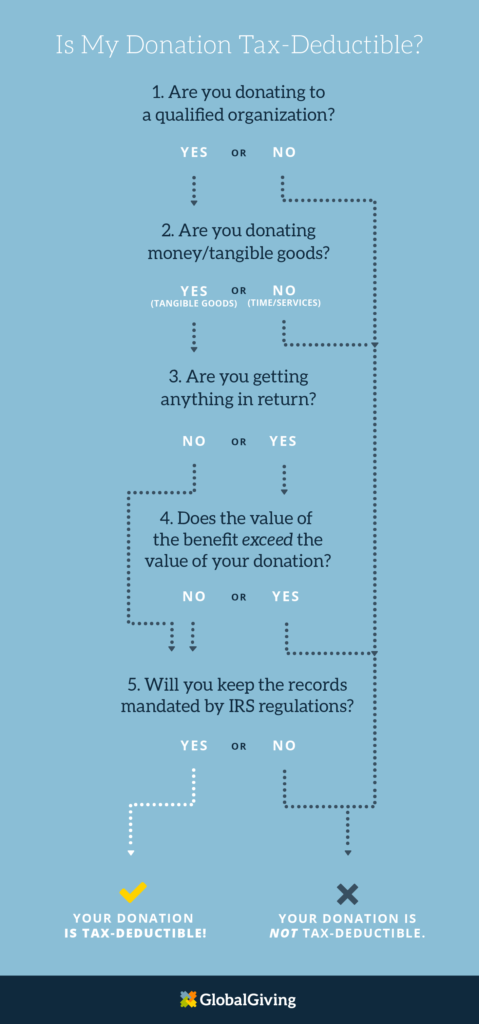

Once you've decided to give to charity, consider these steps if you plan to take your charitable deduction: 1 Make sure the non-profit organization is a 501 (c) (3) public charity or private foundation. 2 Keep a record of the contribution (usually the tax receipt from the charity). 3 If it's a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you're claiming. 4 With your paperwork ready, itemize your deductions and file your tax return.

How much can you deduct from your charitable contribution in 2021?

When you make a charitable contribution of cash to a qualifying public charity, in 2021, under the Consolidated Appropriations Act 1, you can deduct up to 100% of your adjusted gross income.

Does Fidelity give warranties?

Fidelity Charitable makes no warranties with regard to such information or results obtained by its use. Fidelity Charitable disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

What is the federal tax bracket?

Federal tax brackets are based on taxable income and filing status. Each taxpayer belongs to a designated tax bracket, but it’s a tiered system. For example, a portion of your income is taxed at 12%, the next portion is taxed at 22%, and so on. This is referred to as the marginal tax rate, meaning the percentage of tax applied to your income ...

Can you reduce your tax bill if you itemize?

Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally you'd itemize when the combined total of your anticipated deductions—including charitable gifts—add up to more than the standard deduction.

What is marginal tax rate?

In essence, the marginal tax rate is the percentage taken from your next dollar of taxable income above a pre-defined income threshold. That means each taxpayer is technically in several income tax brackets, but the term “tax bracket” refers to your top tax rate.

Is a non profit a 501c3?

Make sure the non-profit organization is a 501 (c) (3) public charity or private foundation. Keep a record of the contribution (usually the tax receipt from the charity). If it's a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you're claiming.

Popular Posts:

- 1. how to donate to texas relief

- 2. where do i go to donate eggs

- 3. where to go to donate hair

- 4. where to donate personal care items near me

- 5. how to create donate button paypal

- 6. why do people donate to the charity

- 7. where to donate for giving tuesday

- 8. how to donate us savings bond to charity after dyeing

- 9. how to donate refrigerator

- 10. where can you donate used toys