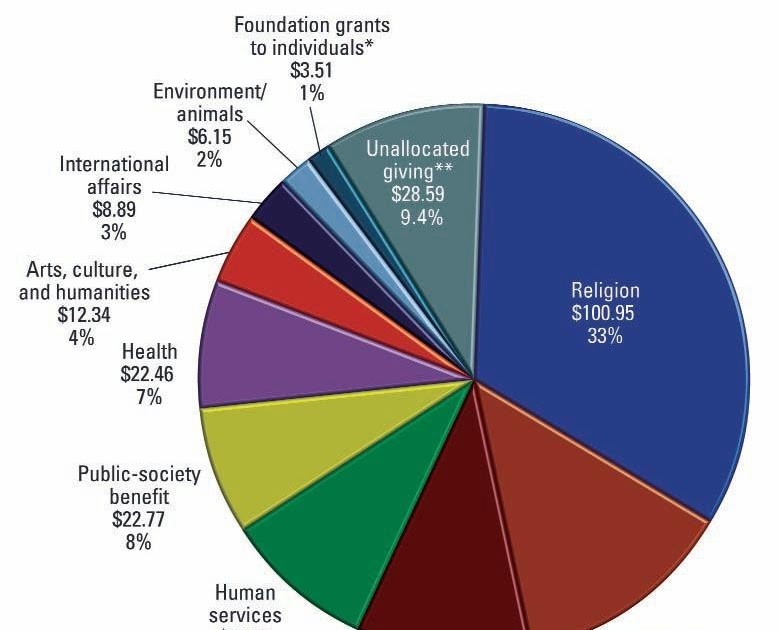

Americans give more than $1 billion a day to charities: a total of $410 billion in 2017. This figure includes giving by individuals, corporations and foundations. Every year the Giving Institute publishes Giving USA, an annual summary of giving in America. Where does all this money come from?

...

What is the Average Donation for Each Income Range?

| Income Range (Adjusted Gross Income) | Average Charitable Donation |

|---|---|

| $100,000 to $199,999 | $4,245 |

How much do Americans give to charity each year?

Six out of ten U.S. households donate to charity in a given year, and the typical household’s annual gifts add up to between two and three thousand dollars. This is different from the patterns in any other country. Per capita, Americans voluntarily donate about seven times as much as continental Europeans.

How much do foundations give to charity?

Jan 03, 2022 · In fact, Americans gave a record $471 billion to charities in 2020, according to Giving USA. This was a 5.1% increase in total giving over 2019. However, adjusted for inflation, it was only 3.8% more than 2019. Even so, 2020 broke the record for charitable giving despite a global pandemic.

What are the sources of charitable giving in the US?

How much do Americans give to charity? Charitable giving statistics have been published annually since 1955 in Giving USA: The Annual Report on Philanthropy , researched and written by the Lilly Family School of Philanthropy at Indiana University and …

Is charitable giving declining among Americans?

Six out of ten U.S. households donate to charity in a given year, and the typical household’s annual gifts add up to between two and three thousand dollars. This is different from the patterns in any other country. Per capita, Americans voluntarily donate about seven times as much as continental Europeans.

How much money does the US donate?

In fiscal year 2020 (October 1, 2019 to September 30, 2020), the U.S. government allocated the following amounts for aid: Total economic and military assistance: $51.05 billion. Total military assistance: $11.64 billion. Total economic assistance: $39.41 billion, of which USAID Implemented: $25.64 billion.

How much did Americans contribute to charity in 2019?

Faced with greater needs, estates and foundations also opened up their pocketbooks at increased levels—resulting in a 5.1% spike in total giving from the $448 billion recorded for 2019, or a 3.8% jump when adjusted for inflation.Jun 15, 2021

Which country donates the most to charity?

Most Charitable Countries 2022CountryOverall RankDonationsUnited States161.00%New Zealand365.00%Ireland569.00%Australia468.00%56 more rows

Who donated the most money to charity in 2020?

Jeff BezosGiving by the fifty biggest donors in the United States totaled $24.7 billion in 2020, with Jeff Bezos topping the list, the Chronicle of Philanthropy reports.

What percentage of money actually goes to charity?

Total giving to charitable organizations was $410.02 billion in 2017 (2.1% of GDP). This is an increase of 5.2% in current dollars and 3.0% in inflation-adjusted dollars from 2016.

What charities donate the highest percentage?

Charity NamePercentage of funds that go directly to the cause, versus administrative or fundraising costsFeeding America's Hungry Children99.10%Caring Voice Coalition99.00%Foster Care to Success99.00%Good36099.00%15 more rows•Dec 28, 2017

Is America a generous country?

The entire nation is altruistic, though the more religious the population, the more it gives. But even 40 percent of secular Americans give to charity, still better than most European nations. Indeed, in the United States, the generous can be found among the wealthy and the poor.Oct 23, 2021

Who is the most generous country?

IndonesiaCAF's 2021 World Giving Index (WGI) shows that Indonesia is the most generous country in the world. Indonesia is ranked first with a score of 69, up from 59 the last time a yearly index was published in 2018, when it also ranked first.Jul 29, 2021

Who is the most generous billionaire in the world?

From Warren Buffett to newcomer Jeff Bezos, the nation's most generous billionaires have given away a collective $169 billion in their lifetimes–and are still richer than ever. T he billions keep piling up for many of America's great philanthropists.Jan 19, 2022

Who is biggest donor in the world?

Greatest philanthropists by amount of USDNameAmount givenBill Gates$35.8 billionWarren Buffett$34 billionGeorge Soros$32 billionAzim Premji$21 billion17 more rows

Where does Jeff Bezos donate his money?

His first multi-billion dollar philanthropic initiative came in 2018 with the Bezos Day One Fund, which aims to establish a network of nonprofit preschools and aid organizations working with homeless people. To date, Bezos has given just over $300 million of the $2 billion he's pledged to the initiative.Jul 22, 2021

How much has Oprah donated?

LOOKING FORWARD: Winfrey has endowed her charitable foundation with nearly $240 million in assets over the last several years.Feb 11, 2022

General Charitable Statistics in the US

Over 80% of all donations to charities and nonprofit organizations in the US come from individuals.

Average Charitable Contributions

The average annual charity donation for Americans in 2020 was $737, according to Giving USA. That figure, however, is a bit misleading. Let’s look at why, using figures from their reports:

Charitable Giving by Month

December is the most popular month for charitable giving, and both December of 2019 and 2020 were no exceptions to this rule.

Charitable Giving by Income Group

The chart below, from the Tax Policy Center, shows us two surprising things:

Charitable Giving by Age Group

Now, let’s look at how each generation gives, how much they give, and where their charitable dollars go. We’ll start with Millennials and work our way up to the senior seniors of the Silent Generation.

Religious & Church Charitable Giving Statistics

All four major donor generations give to local places of worship. Let’s look at religious giving more closely.

Volunteer Fundraising Statistics, Facts & Trends

We’ve already established that Baby Boomers are typically the most active volunteers. Let’s look at some other facts surrounding volunteering.

Have a question about this topic? Ask us!

Candid's Online Librarian service will answer your questions within two business days.

2009 Household Charitable Giving Down Five Percent from 2008

Press release summarizes findings based on the CWP's Individual Giving Model. The full report will be published in the July/August 2010 issue of Advancing Philanthropy, the magazine of the Association of Fundraising Professionals.

Blackbaud Index of Charitable Giving

A broad-based fundraising index that reports revenue trends of 1400 nonprofit organizations representing $2.2 billion in yearly revenue on a monthly basis. The Index is based on actual revenue statistics from nonprofit organizations of all sizes represent

Center on Wealth and Philanthropy

Links to previous research projects the Center on Wealth and Philanthropy has conducted related to wealth, giving and social impact.

Charitable Giving Statistics

Provides summary statistics on giving by institutions and individuals and includes information on donor-advised funds, supporting organizations, and other charitable entities.

Giving Statistics

This agency within the federal Department of the Interior provides a useful roundup of charitable giving statistics and analysis of the data. The webpage includes the 2009 Giving USA pie charts/data on giving by source and by recipient type:

Individual Noncash Charitable Contributions

Provides data on noncash charitable contributions over the past few years, based on tax-returns.

How much charitable giving is there in 2019?

In 2019, the largest source of charitable giving came from individuals at $309.66 billion, or 69% of total giving. In four of the last five years, charitable giving by individuals has grown.

How much money did Americans give in 2019?

Americans gave $449.64 billion in 2019. This reflects a 5.1% increase from 2018. 1. In 2019, the largest source of charitable giving came from individuals at $309.66 billion, or 69% of total giving. In four of the last five years, charitable giving by individuals has grown.

How much did corporate giving increase in 2017?

Corporate giving in 2017 increased to $20.77 billion— an 8.0% increase from 2016. [1] Foundation giving in 2017 increased to $66.90 billion—a 6.0% increase from 2016. [1] In 2017, the largest source of charitable giving came from individuals at $286.65 billion, or 70% of total giving; followed by foundations ($66.90 billion/16%), ...

How many people will be in the 2020 Gallup poll?

Results for this Gallup poll are based on telephone interviews conducted April 14-28, 2020, with a random sample of 1,016 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

How many people have filed for unemployment?

More than 33 million Americans have filed for unemployment benefits as stay-at-home orders designed to slow the spread of the virus have brought much of the U.S. economy to a halt.

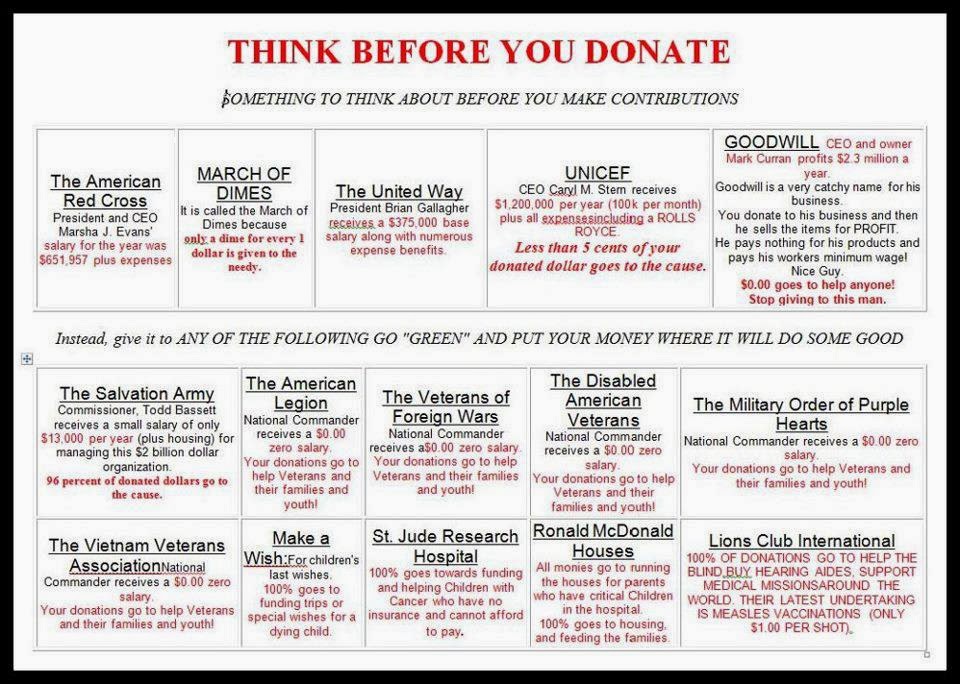

What is candid nonprofit?

Candid (formerly GuideStar) is designed for nonprofit organizations to show their commitment to transparency and communicate directly with stakeholders. Lastly, learn more about the Overhead Myth. It's understandable that you want to invest in a cause, not line a nonprofit executive's pocket. But the fact is that overhead—the percent ...

What is overhead in nonprofits?

Overhead is a simple financial ratio that tells us nothing about a nonprofit's true impact or effectiveness.

How much is the standard deduction for charitable giving?

The biggest change in the Tax Cuts and Jobs Act that could affect charitable giving is the near-doubling of the standard deduction to $12,000 for single taxpayers and $24,000 for married taxpayers filing joint returns. Here's why this matters.

How many charitable donations were deducted from taxes in 2016?

A total of 36.95 million tax returns claimed a deduction for charitable contributions made during the 2016 tax year, the most recent year for which data is available. And to be clear, these are the tax returns Americans filed in 2017.

Who is Matt from Motley Fool?

Author Bio. Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work!

Popular Posts:

- 1. where to donate blankets for the homeless

- 2. who is not eligible to donate blood

- 3. how to donate an old printer los angeles

- 4. where can you donate furniture near me

- 5. how to get stores to donate items

- 6. donate plasma what do i need

- 7. where to donate blood in richmond va

- 8. where to donate a hosptial bed

- 9. how much to donate.

- 10. where can i donate a kiln