How much does the average person donate to charity?

| Income Range (AGI) | % of income given to charity |

| Under $15,000 | 13% |

| $15,000-$29,999 | 8% |

| $30,000-$49,999 | 7% |

| $50,000-$99,999 | 5% |

What are the best and Worst Charities to donate to?

AdUNICEF is on the Ground in Eastern Ukraine Ramping Up Assistance for Children. Donate Now! Your Support Helps Save and Protect the World's Most Vulnerable Children

What percentage of donations go to charity?

AdHassle Free Process & No Paperwork For You. Takes Just 2 Minutes - Start Now

How to get charity donations and raise money?

AdWhen You Donate To The Nature Conservancy You Become A Member. This Is Your Chance To Help Our Planet Meet The Challenges Of The Coming Years

How much should you give to charity?

Stop Land Destruction · Stop Land Destruction · Conserving Our Oceans · Protect Land & Water

How much does the average person donate to charity?

Average Charitable Contributions The average annual charity donation for Americans in 2020 was $737, according to Giving USA.Jan 3, 2022

What is a good donation amount?

A typical amount that people aspire to donate ranges from 3 percent to 10 percent of their taxed income, and often is influenced by religious affiliation [source: Weston]. Some branches of Christianity, for example, encourage their followers to donate 10 percent of their earnings to the church or to charities.

What is the charitable contribution limit for 2020?

For 2020, the charitable limit was $300 per “tax unit” — meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.Nov 30, 2021

How much does donating to charity reduce taxes?

When you donate cash to a public charity, you can generally deduct up to 60% of your adjusted gross income.

How much charity can you deduct in 2021?

$300When you don't itemize your tax deductions, you typically won't get any additional tax savings from donating to charity. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction.Dec 16, 2021

How much can you donate to a friend's charity?

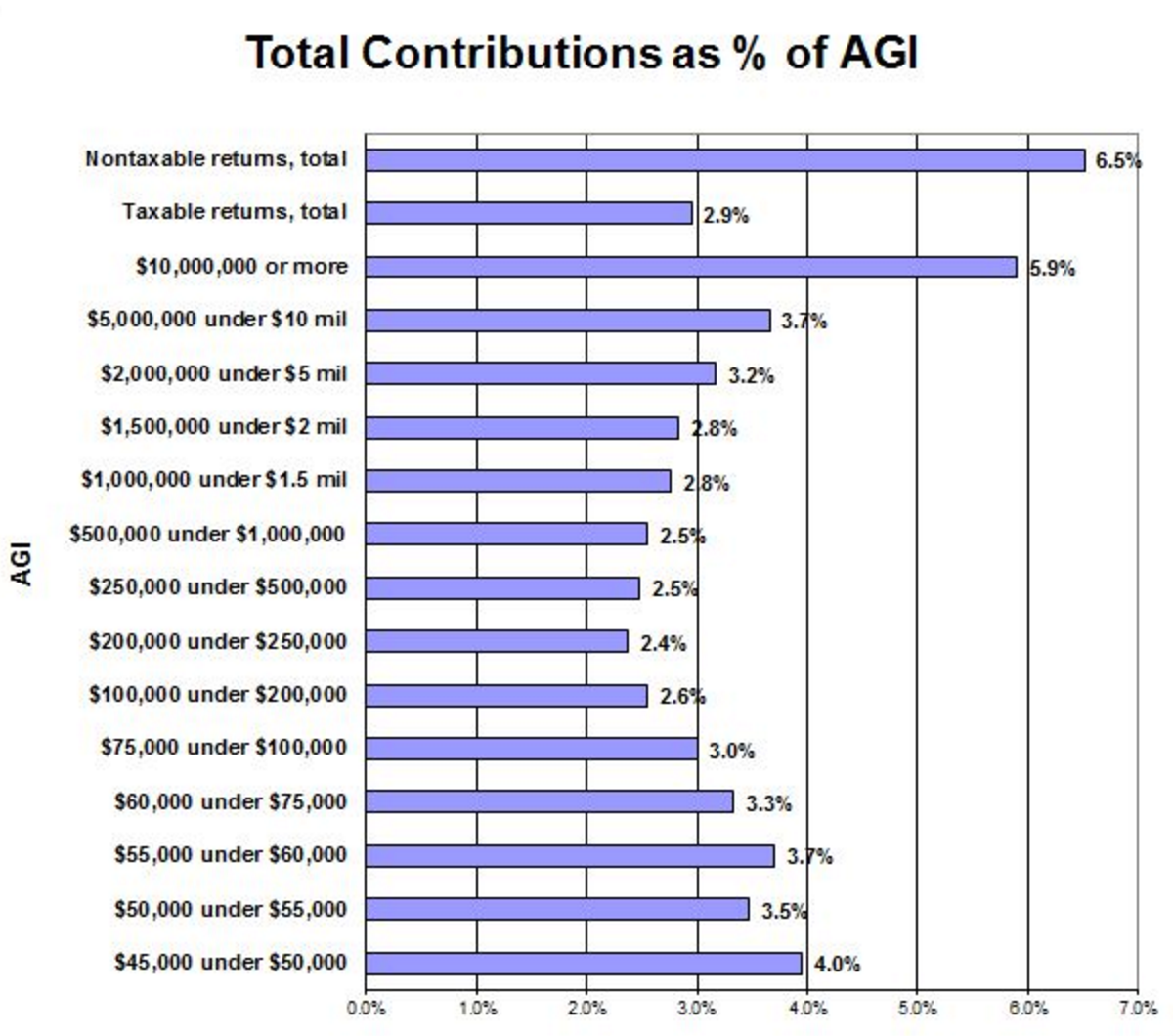

If you care about helping others but don't want to give more than average, you could aim to give what an average person gives. This can vary significantly by income level and country, but for many people this is roughly 2-6% of their income.May 28, 2021

Is the $300 charitable deduction per person?

For 2020, the charitable limit was $300 per “tax unit” — meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.Dec 16, 2021

What is the 30% limit on charitable contributions?

One rule to remember here is that the deduction is limited to 30% of your adjusted gross income (AGI). If you're not able to use the entire donation deduction this year, you can still carry forward unused deductions for five years.Dec 10, 2021

Are church donations tax deductible in 2021?

Limitations on annual church donations However, the amounts you can't deduct this year can be used as a deduction on one of your next five tax returns. For tax years 2020 and 2021, the contribution limit is 100% of your adjusted gross income (AGI) of qualified cash donations to charities.Jan 10, 2022

Does the IRS check charitable donations?

The problem is that it is up to the taxpayer to determine the value of goods that are donated. As a general rule, the IRS likes to see individuals value the items they donate anywhere between 1% and 30% of the original purchase price (unless special circumstances exist).

How much can you claim in charitable donations without receipts 2020?

Following tax law changes, cash donations of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when people file their taxes in 2021.Dec 14, 2020

Do I have to pay taxes on GoFundMe money?

GoFundMe says the money raised on the site is typically not taxed. That could be a gift of any amount,” explained Camenson. “You could get a gift of a million dollars, you don't count it.Jan 24, 2022

How much does the average person donate to charity?

The average person donates about $5,931 per year to charity. That’s close to $500 per month. This figure was calculated using the 38 million tax returns filed during the 2017 tax year, the most recent year for which data is available.

Is it better to give to one charity or many?

If you feel strongly about just one issue, then you can choose to focus your charitable efforts on that one charity. But if the spirit moves you to help with many causes, that’s great too.

How much should you budget for charity?

Start with 1% of your income, then work your way up. If you make $100,000 a year, that’s $1,000 per year going to a public charity, or $20 per week. That’s very doable.

How much can you donate to Charity?

There is no legal limit on how much you can donate to charity. You can donate your entire savings and property to charity if you feel called to take a vow of poverty or live a truly minimalist life.

Is there a limit on charitable donations for 2021?

For 2021, you can deduct cash donations of up to 100% of your adjusted gross income, if it was made to a qualifying public charity. This is temporary, as a result of the Consolidated Appropriations Act signed into law in December 2020. Gifts to donor-advised funds (discussed below) are not eligible for this special election.

Are all donations tax-deductible?

Not all donations can be deducted from your tax return. If you gave money to a homeless person or to a friend to help cover medical costs or funeral expenses, these are not tax-deductible. You cannot deduct donations from a political campaign. If you donated money to a nonprofit for advocacy or lobbying purposes, these are not tax-deductible.

Can I deduct mileage for volunteer driving?

To be deductible, you must have volunteered to a qualifying charity, you weren’t reimbursed, and the travel expense was incurred primarily due to the volunteer work. For example, if you went on a week-long vacation and volunteered for a few hours, you cannot deduct your vacation travel expenses.

What is a donor advised fund?

A donor advised fund is a separately titled investment account for which you have control over when you donate and when/who you gift to.

How much can you deduct on 2019 taxes?

The new law increased the standard deduction to $12,000 for individuals and $24,000 for couples in 2019, and capped the amount of state taxes you can deduct to $10,000 per individual or couple. Therefore, it’s harder for most people to itemize.

Is a mortgage deduction deductible?

If your mortgage deduction and state tax deduction already exceed the standard deduction amount than any amount of your charitable gifts will be tax deductible. What this amounts to is about a ~30% or so “discount” on your gift (your actual discount will depend on your state and federal tax rate).

Do you have to be a 501c3 to donate to a charity?

All of the grants to charities from the DAF have to be qualified 501 (c) (3)s. You can claim a deduction the year you donate to the fund, but send out gifts to charities in a frequency that works for you (annually, every other year, every 5 years, etc.)

Is there a $300 deduction for 2020?

UPDATE: The IRS is allowing a $300 deduction for charitable contributions in 2020 as part of the CAREs Act covid-19 response regardless of income or itemized deductions. This special deduction applies to any charitable contribution, it doesn’t necessarily need to be related to covid-19 relief.

Popular Posts:

- 1. how to donate my body to science after death

- 2. where can i donate toys in chicago

- 3. where can i donate blood

- 4. how to donate to salvation army drop off

- 5. who wants to donate money

- 6. where can i donate old vcr tapes

- 7. where to donate box springs near me

- 8. how to donate to texas border wall

- 9. where to donate wedding dress ny

- 10. where can i donate single shoes for veterans