What to know before donating a car to charity?

Feb 28, 2020 · How to Donate Your Car to Charity If you plan on donating your car to charity, make sure you do the necessary research first. Begin by selecting a non-profit organization to receive your vehicle. Double-check that the organization is a 501 (c) (3) to ensure you do not accidentally donate to a for-profit organization disguising itself as a charity.

Where can you safely donate your car to charity?

How to donate your car: Go to our online donation wizard or call 1-877-277-4344. Provide your vehicle information and contact information. Schedule your car to be picked up. Start your donation today Need help? Email us at [email protected] or call 1-877-277-4344. “I could not believe I could donate my junk car and help Habitat for Humanity.

Is donating a car to charity worth it?

There are dozens of charitable organizations that accept vehicle donations. The first step of the vehicle donation process is deciding which charity is worthy of your donated vehicle. This would be the same question to answer if you were making a cash donation to the charity. There are many online resources for evaluating reputable car donation charities and you can find out …

How to find the best charities to donate your vehicle?

The most important thing to verify is that donating a car is possible with the charity. Most of the time that means it must be registered with the IRS as a 501(c)(3) nonprofit. Ensure You Can Donate Your Car. Once you've identified a couple non-profits in the area you'd like to support, find out if they accept car donations. Not all non-profits are equipped to handle that type of donation.

Is donating a car a good idea?

If you're focused on getting rid of a junker with minimum effort and you'd look at the tax deduction as a nice bonus, then donating your car makes good sense. But if your goal is to maximize your tax deduction, carefully review these steps, consult with your tax adviser and then make your decision.Oct 24, 2017

How do you value a car donated to charity?

If the charity sells your car sells for $500 or less, you can deduct $500 or your car's fair market value, whichever is less. For example, if your car is valued at $650 but sells for $350, you can deduct $500. Most charities will report the sales price of your car to you on Form 1098-C.Oct 16, 2021

Is car donation considered a gift?

The value of your write-off is equal to the value of your car, as determined by Internal Revenue Service valuation rules. If you donate your car to any party other than a qualified nonprofit organization, however, you enjoy no tax benefits and you may even subject yourself to gift tax liability.

What is the maximum charitable deduction for a car donated without itemizing?

$500A tax write-off for a car donation is a way that you can a benefit from the non-cash charitable donation of a motor vehicle. In most cases, donated vehicles that sell for less than $500 are able to be claimed at the fair market value up to $500 without filling out any extra paperwork.

How to donate a car to a non profit?

To donate your vehicle, complete the online donation form or call the nonprofit at 855-500-RIDE (7433) and schedule a free pickup time convenient for you. In some cases, it can pick up your vehicle as soon as the day you call. You receive a donation receipt from the representative who picks up your vehicle.

What is a car donation?

Charitable Adult Rides & Services (CARS) is a nonprofit vehicle donation service that serves other charities. That makes it a unique hybrid of car sales service mixed with charitable organization. It also provides meals and transportation to seniors through a program called On the Go.

What are the charities that are partners?

Partner charities include organizations like: 1 Animal charities 2 Charities that focus on curing or supporting individuals with specific diseases, such as lupus, diabetes, and cancer 3 General humanitarian charities, such as the Red Cross

What is Wheels for Wishes?

The car donation program Wheels For Wishes benefits the Make-A-Wish Foundation, which works to grant the wishes of children diagnosed with critical illnesses. As stated in the charity’s mission, granting these wishes can be the spark of hope that gives children and their families the strength to persevere during a difficult time.

How long does it take to get a 1098C from a car donation?

Once your donation is complete — the charity sells your donated vehicle at auction or recycles it for scrap metal or parts — you receive either a sales receipt or IRS form 1098C, depending on the sale price of your vehicle, within 30 days of the sale. 3. Charitable Adult Rides & Services.

Is "donate a car" a charity?

Donate A Car isn’t a charity in itself. It’s a vehicle donation service offered by the North American auto auction company Insurance Auto Auctions Donation Division. It picks up and auctions off your car and allows you to choose which of its 300 charity partners receives the profits of the sale. Unlike scammers to be wary of, Donate A Car gives 70% or more of the sale price to its partner charities.

What is cash auto salvage?

According to New York-based salvage company Cash Auto Salvage, charities recycle nonworking vehicles for their scrap metal and parts, potentially bringing in a few hundred dollars for a char ity. But according to vehicle paint meter manufacturer FenderSplendor, working vehicles bring in even more.

What is advanced remarketing services?

Advanced Remarketing Services is our authorized agent and attorney-in-fact for the purpose of selling vehicles and transferring titles. They handle the title transfer, towing and reporting of all vehicle donations. Vehicle donations may be made online through the donation wizard or by calling 1-877-277-4344.

How old is Ernie from Habitat for Humanity?

It had been a year since Ernie, an outgoing 87-year-old U.S. Army veteran, had been outside on his own. After months of this kind of physical isolation, and months of encouragement from his social worker, Ernie applied for Habitat for Humanity of Greater Lowell’s Critical Home Repair Program.

Does Habitat receive donations?

Habitat receives funds for each donated vehicle , although a car sold at auction generally generates more revenue than one that is recycled. Every donation makes a difference and the families that partner with us are extremely grateful for your help.

Navigating charitable vehicle donations

Do you have a car that’s not worth trading towards the purchase of a new car? Perhaps you have a vehicle that you rarely drive and is taking up space in your driveway and you’d just like it to go away without a hassle?

How to choose a vehicle donation charity

There are dozens of charitable organizations that accept vehicle donations. The first step of the vehicle donation process is deciding which charity is worthy of your donated vehicle. This would be the same question to answer if you were making a cash donation to the charity.

What kinds of vehicles can you donate to charity?

When it comes to vehicle donations, many people think it begins and ends with cars. You might be surprised to learn that the HSUS vehicle donation program accepts a large variety of vehicles. Below is a list of used vehicle donation types we accept:

What happens to donated cars?

In addition to selling cars past their useful life to salvage yards for a return on their value as scrap, the HSUS’s vehicle donation program has several tiers of vehicle disposal. We implement such as system in order to yield the highest return from your donation.

Can you donate a car without title?

You do not need a title in hand to begin the process. Just be aware that the sale may be delayed until the title has cleared. If this is your situation please make every effort to locate your title. You can begin with visiting your local DMV.

Can you take a tax deduction for donated vehicles?

As you’re probably aware, most anything to do with taxes can be complicated and the usual disclaimer to “seek the advice of a qualified tax preparer or financial advisor” certainly applies in the case of tax deductions for donated vehicles. The good news is you may be eligible to deduct your vehicle donation to charity.

Three easy steps to donating your vehicle to the HSUS

If you’ve done the homework in the previous sections (wasn’t too hard, was it?) and decided to gift your vehicle to the Humane Society of the United, then let’s drive things across the finish line, regardless if your vehicle is running or not:

How to deduct car donation on taxes?

The deduction you can take on your tax return will only be based on the fair market value of the car if the charity does one or more of the following: 1 Uses donated cars in a way that's significantly beneficial to the community (e.g. Meals on Wheels). 2 Makes major repairs to the vehicle, thus increasing the value of the car. 3 Sells or donates the car to a person in need at a below-market price.

Can I donate my car to the DMV?

From the perspective of the DMV, donating your car is similar to selling your car. All the paperwork for a title transfer plus canceling your registration still applies. The exact steps you'll need to take will vary from state to state. Contact your local DMV office for specific requirements and details.

Can I give money to a non profit?

It's very easy to give money or an in-kind donation to a non-profit. The hard part is making sure the non-profit deserves your gift and that you are confident the organization is spending its resources wisely.

How to donate a car to a charity?

Stay on top of the steps you will have to take when donating a car to charity: 1 Select a charity. 2 Understand the IRS requirements for car donations. 3 Don't forget the DMV requirements. 4 Cancel your car insurance as soon as you can.

How to keep track of car donations?

There are many steps to keep track of when donating your car. You have to find a charity you like and that accepts car donations. Then you have to accurately calculate the fair market value of your car in order to take the right tax deduction the following April—not to mention filing your taxes with the appropriate forms when necessary. ...

When do you have to cancel your car registration?

Some states require you to cancel your vehicle registration as soon as the car is no longer in your possession. This goes hand-in-hand with returning the license plates to your DMV (if necessary).

Do you have to notify the DMV of a car donation?

Although the completion of the title transfer is the responsibility of the organization receiving the car donation, you should consider notifying the DMV that you have donated the car. This will help release you of any liability associated with the car.

Can I return my license plate?

Return Your License Plates. While not always the case , most states allow you to keep your license plates whenever you transfer ownership of your car to another person or organization. This includes instances of car donation. Some states may require you to surrender your plates to the DMV.

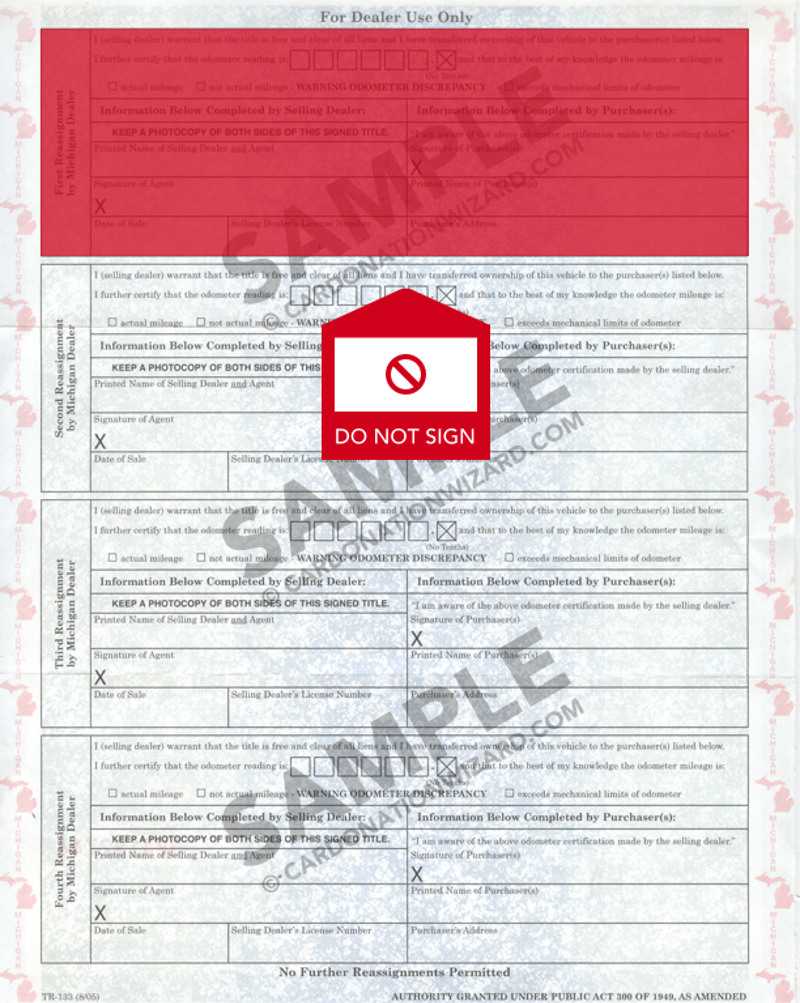

Can I transfer my car title to a charity?

Transferring Your Title to a Charity. The title of a car is its proof of ownership, and it will have to be transferred to the charity as part of the gift. If the charity you select regularly receives cars as donations, they will have a process set up to make the transfer of ownership of the car as easy as possible.

Popular Posts:

- 1. how much percentage of profit has to donate in order to be considered non-profit

- 2. where can i donate old television sets

- 3. how to donate money in bloxburg

- 4. how to get paid to donate feces

- 5. where can i donate hospital bed

- 6. how to support candidate if you can't donate

- 7. who can donate to blood type o

- 8. where to donate shoes and clothes

- 9. how to insert a donate button in a eblast

- 10. where to donate box spring