Items Goodwill cannot accept include:

- Mattresses/Box Springs

- Bedframes

- Waterbeds

- DLP TV’s

- Tires/Tire Rims

- Children Car Seats, Cribs, & Playpens

- Medicine

- Furniture with tears, stains, animal fur, or broken parts

- Built in appliances

- Hazardous, flammable, or toxic materials such as paint & gasoline

What you can and cannot donate to Goodwill?

Why you should never donate to Goodwill? If Goodwill can’t sell your clothes, it ships them to sell to third world countries overseas — a practice that is widely documented as harming industry in developing nations by importing cheaply priced goods- …

What items will goodwill not accept?

Mar 21, 2017 · WHAT YOU CANNOT DONATE. There are some items that Goodwill usually will not accept. Again, if you are questioning whether or not to donate an item, it’s best to give your local store a call. Donating your clothes and household items to Goodwill is a win-win for you and your community. You get to reduce the clutter in your home, and Goodwill is able to help people …

What not to donate to Goodwill?

We appreciate your donations to Goodwill, but there are certain items we are unable to accept out of concern for the safety of our associates, donors, and shoppers. Goodwill does not accept certain items, including but not limited to: Building materials (carpet, shutters, sinks, flooring, etc.)

What items will goodwill accept as donations?

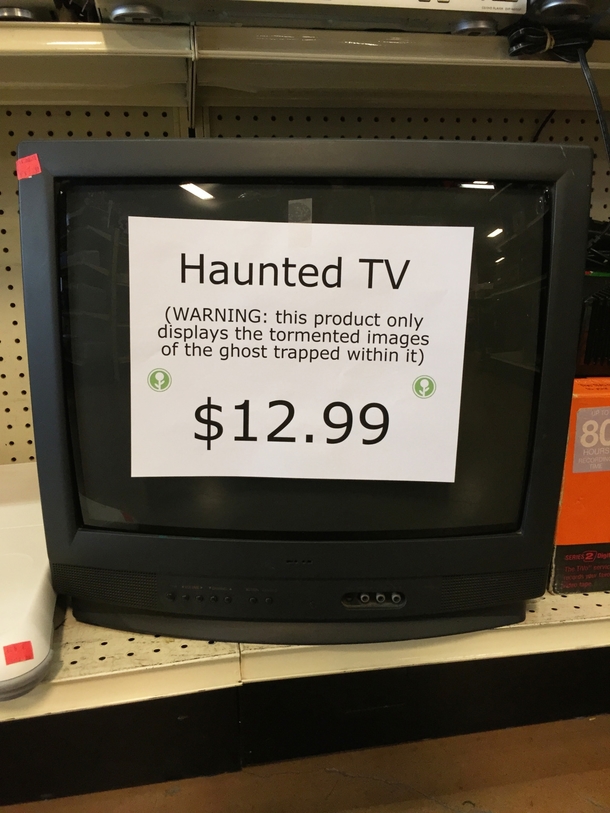

Apr 01, 2022 · Items to Avoid Donating: broken electronics. unrepairable appliances. large household appliances. clothing with rips, tears, and broken zippers. damaged shoes. glassware with chips and cracks. baby cribs, car seats, strollers, and other baby equipment. CRT televisions and computer monitors. ...

Frequently Donated Items

We accept new or gently-used donations of clothing, electronics and household items at any of our 11 convenient donation locations. Furniture donations may also be dropped off at any of our retail stores. Items that we always appreciate include:

Items We Cannot Accept

It’s hard to say “no thank you” to a donation. However, there are some items we simply can’t accept because they are excessively soiled or broken, too costly to dispose of, or have been recalled due to product safety issues. Safety is very important to us, so we encourage everyone to be aware of potential product safety hazards before donating.

Can Goodwill employees refuse donations?

Goodwill employees may decline a donation if it is not in clean or in saleable condition or if they are unable to assist with larger items due to risk of injury. Our employees often help unload donations, however cannot help if (in their judgement) doing so may damage any vehicle, or if doing so is unsafe for them or anyone else.

Is Goodwill donation tax deductible?

Donations should be clean, safe and resaleable. Your donations to Goodwill are tax deductible. You can find all donation sites here. We are unable to do home pick-ups. To find a list of items we cannot accept, please scroll to the next section.

What Not to Donate to Goodwill and Other Nonprofits

It’s possible to have too much of the wrong things, and that’s why learning what not to donate to Goodwill and other nonprofits is so important.

How to Donate Responsibly

So, how do we prevent adding to the pileup and reduce this burden on philanthropic organizations and their employees and volunteers? The answers are fairly intuitive.

What appliances are dangerous?

These appliances also take up a lot of space. Microwaves or freon-based appliances: Microwaves are another item that can become dangerous if damaged or otherwise old.

What devices can I use to watch old school movies?

VCRs, DVDs, and streaming devices: Though you may only use the internet and other devices to view shows and movies, many people still enjoy more “old school” options or look for ways to watch VHS tapes and DVDs. Projectors and classroom aids: Projectors and other similar devices may help out teachers on a budget.

Is Goodwill low on space?

Some Goodwill facilities are low on space or have to use their space wisely in general. Bulky, heavy, or oversized appliances are not the best items to keep in stock for the organization’s capacity.

Does Goodwill take RVs?

Or, perhaps you’re downsizing or moving somewhere where storage spaces are scarce or expensive. RVs and fleet vehicles: Yes, Goodwill takes even the largest vehicles out there.

Does Goodwill accept electronics?

Consumer electronics: Goodwill accepts a wide variety of other electronics, such as camcorders, remote controls, tape players, and more.

Do books need batteries?

Books: Books don’t require batteries, updates, or any additional installation. As long as they’re in decent shape, donate them to Goodwill. Toys for all ages: Some children grow tired of toys quickly. Donating toys to Goodwill provides opportunities for families to buy “new” toys at better prices.

Is Goodwill a good place to recycle clothes?

Plus, recycling clothing is a great way to help out the environment. Many people think they can never have enough clothing.

What is the fair market value of a property at the time of donation?

The IRS Publication 561 states: The condition of the item or household good that is not in a good used condition or better for which you take a write-off of more than $500 requires a qualified appraisal.

What is a qualified charitable organization?

A qualified charitable organization is a nonprofit organization that qualifies for tax-exempt status according to the U.S. Treasury. Qualified charitable organizations include groups operated exclusively for religious, charitable, scientific, literary, or educational purposes, or the prevention of cruelty to animals or children, or the development of amateur sports. As mentioned above, only donations that are made to a qualified charitable organization are tax-deductible. For example, let’s say, you donated $10,000 to political parties. Although this is a great way to get involved in politics and your community, donations to political organizations or candidates are not tax-deductible.

When to itemize contractor taxes?

Generally, taxpayers choose the larger deduction, standard or itemized, when it’s time to file your independent contractor taxes . You’d itemize when the combined total of your expected deductions – including charitable donations – add up to more than the standard deduction.

How much can you deduct from a qualified contribution?

As such, individuals can deduct up to 100% of their adjusted gross income and corporations can deduct up to 25% of their taxable income.

What is fair market value?

Fair market value (FMV) is that property would sell for on the open market. In other words, it is the value of your donation. It is the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and not having reasonable knowledge of the relevant facts.

What is a cash contribution?

Cash contributions include payments made by cash, check, electronic funds transfer, online payment service, debit card, credit card, payroll deduction, or a transfer of a gift card redeemable for cash.

Can you deduct charitable contributions?

This article explains how you can determine the value of donated property given to qualified organizations, the types of organizations to which you can make deductible charitable contributions, and the types of contributions you can deduct. It also discusses any limit for contributions ...

Popular Posts:

- 1. where to donate old toys near me

- 2. why to donate toys for lurie childrens hospital

- 3. where to donate food for christmas near me

- 4. what happens if an anemic person donate blood

- 5. where to donate greeting cards

- 6. how do i donate clothing and goods to veterans in las vegas?

- 7. how to donate to dueling nexus

- 8. how much did dolly parton donate to moderna

- 9. where to donate prom dresses

- 10. how to add donate button to facebook page