Where to Donate Your Stimulus Check

- CDC Foundation The CDC Foundation is an independent nonprofit created by Congress to mobilize philanthropic and private-sector resources to support the Centers for Disease Control and Protection’s critical health protection work. That work i s extra-critical right now, so consider the CDC Foundation as a potential donation option.

- Center for Disaster Philanthropy ...

- Feeding America ...

- GiveDirectly ...

Full Answer

How to use stimulus money to support local restaurants?

Do people get stimulus checks?

About this website

How to use stimulus money to support local restaurants?

You can use your stimulus money to support local restaurants in the following ways: Purchase meals, gift cards, or merchandise from them. Donate to them directly. Create a crowdfunding fundraiser on their behalf, or contribute to an existing fundraiser that they have set up.

Do people get stimulus checks?

Under the CARES Act, the US government has issued one-time cash payments of $1,200 to millions of Americans earning $75,000 or less across the country. While these stimulus checks come as lifelines to many Americans, helping them cover pressing expenses like rent payments and groceries, that’s not the case for all stimulus check recipients. Consequently, those who don’t urgently need the money from their stimulus checks are choosing to donate their stimulus money to help people in need. In this article, we’ll explore some of the many ways in which you can also donate your stimulus check to make a positive impact during this time of crisis.

What is the Center for Disaster Philanthropy?

The Center for Disaster Philanthropy gives you the opportunity to contribute to a COVID-19 disaster response fund that will be used to support preparedness, containment, response and recovery activities related to the coronavirus. Charity Navigator highlighted the Center for Disaster Philanthropy in its list of nonprofits responding to COVID-19, so it comes well- recommended.

What is the CDC Foundation?

The CDC Foundation is an independent nonprofit created by Congress to mobilize philanthropic and private-sector resources to support the Centers for Disease Control and Protection’s critical health protection work.

What is the money that children of restaurant employees get?

With $50, the group says it can cover a child’s out-of-pocket medical expenses for a week , while $150 will pay for a family of four’s weekly groceries.

Did undocumented immigrants get the first aid package?

Undocumented immigrants weren’t included in the first coronavirus aid package, and they’re not in this one either — although this time, if they are married to an American, their spouse will get a check.

What can I do with my stimulus check?

One possible use of your stimulus payment is to donate the money to a worthy cause. While charitable intentions for the greater good are their own reward, the tax code also rewards a charitable donation with a tax deduction. It would go toward your 2020 income taxes (i.e. on next year’s tax return, filed by April 15, 2021).

Why do people donate stimulus money?

While the extra cash is nice, many recipients recognize that less fortunate people, including families and beneficiaries of charity , urgently need the money more than they do . Others may use it as a political statement. Alternatively, you may not immediately need the money and feel the adjusted gross income test for eligibility does not reflect your current financial situation or compensation income (the factors below assume the IRS has your 2019 tax return):

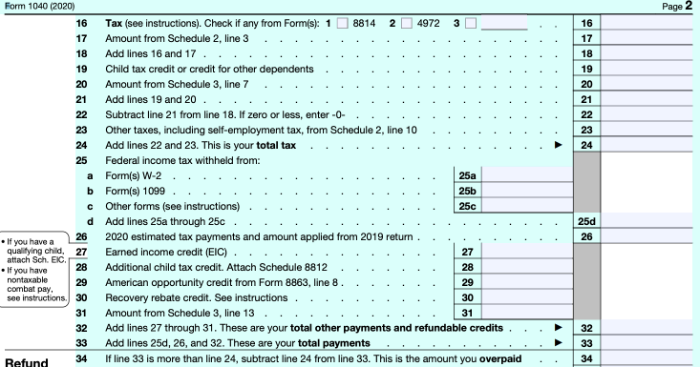

What line is the stimulus check based on?

Whether you’re eligible for the stimulus is based on your adjusted gross income (AGI) on your tax return for 2018 (see line 7) or 2019 (see line 8b). There are income phaseouts that reduce or completely eliminate your eligibility for the payment. These impact the size of the check you receive.

How much can I deduct for charity in 2020?

For the 2020 tax year, if you use the standard deduction amount instead of itemizing deductions, you can claim up to a $300 deduction on your tax return for a cash donation to a charity directly off your adjusted gross income (i.e. an "above the line" deduction).

What are the rules for tax deductions for donations?

Let’s look at some key federal tax rules that apply to your donation, whether by cash, check, or credit card (while most states follow the federal rules, not all do, and some don’t have an income tax): 1. Gifts Versus Donations: Not All Acts Of Kindness Are Tax-Deductible.

Is a gift to a charity tax deductible?

Unfortunately, these acts of kindness are gifts that are not tax-deductible. As the IRS website explains, a contribution or gift to an individual is “never deductible.”. Gifts made directly to foreign charities are also not deductible, although there are other options for international philanthropy. 2.

Do you itemize a $300 donation on your taxes?

You do not itemize on Schedule A of your tax return and instead claim the standard deduction. When you make a $300 donation, this amount comes off your taxable income. It reduces your federal taxes by $66 (22% marginal tax rate x $300). The $300 donation has a “cost” of only $234 ($300 minus $66). 4.

How to use stimulus money to support local restaurants?

You can use your stimulus money to support local restaurants in the following ways: Purchase meals, gift cards, or merchandise from them. Donate to them directly. Create a crowdfunding fundraiser on their behalf, or contribute to an existing fundraiser that they have set up.

Do people get stimulus checks?

Under the CARES Act, the US government has issued one-time cash payments of $1,200 to millions of Americans earning $75,000 or less across the country. While these stimulus checks come as lifelines to many Americans, helping them cover pressing expenses like rent payments and groceries, that’s not the case for all stimulus check recipients. Consequently, those who don’t urgently need the money from their stimulus checks are choosing to donate their stimulus money to help people in need. In this article, we’ll explore some of the many ways in which you can also donate your stimulus check to make a positive impact during this time of crisis.

Popular Posts:

- 1. where can i donate my old prescription glasses

- 2. where to donate kitchen items

- 3. how to donate canned food

- 4. where to donate clothes for afghan refugees

- 5. what charities should i donate to

- 6. how to donate to senate democrats

- 7. where to donate testicles

- 8. where can you donate breast milk

- 9. where to donate vehicles for tax deductions

- 10. craftofclans how to donate to other palyers