3 Most Popular Car Donation Charities that Will Maximize Your Tax Deduction

- Habitat For Humanity - Cars For Homes Habitat For Humanity's Cars For Homes program works directly with donors to reduce the amount of costs paid in the sale of ...

- American Cancer Society - Cars for a Cure Cars for a Cure is another popular choice. They sell donated cars and use the proceeds to fund cancer research. ...

- National Kidney Foundation

Full Answer

How do tax deductions work when donating a car?

Suggestions On How To Get Your Tax Deduction For A Car Donation: Set up a car donation with an IRS registered 501 (c) (3) charity of your choice. With Wheels For Wishes all you need to do is fill out an online donation form or call us at 1-855-278-9474 and we'll do the rest for you!

How to find the best charities to donate your vehicle?

Jan 21, 2022 · In Notice 2005-44, the IRS and Treasury explain rules adopted in the American Jobs Creation Act of 2004, which (1) generally limits the deduction to the actual sales prices of the vehicle when sold by the donee charity, and (2) requires donors to get a timely acknowledgment from the charity to claim the deduction. Donors may claim a deduction ...

Where to donate a car to charity?

Oct 16, 2019 · Donating your car to charity can result in significant tax savings if you include it in your charitable contribution deduction. The Internal Revenue Service (IRS) requires you to calculate your tax deduction in one of two ways, depending on how the charity uses your donation. Deductions for cars the charity sells are limited to the sales price.

How do you donate a car to charity?

Nov 09, 2021 · It depends on the car, but most donations fall into three categories: Under $500 Over $500 but less than $5,000 Over $5,000 In order to be eligible for a tax deduction, a car must be donated to a tax-exempt nonprofit organization, also known as a 501 (c) (3). Kars4Kids is a nationally recognized 501 (c) (3) nonprofit.

Is donating a car a good idea?

If you're focused on getting rid of a junker with minimum effort and you'd look at the tax deduction as a nice bonus, then donating your car makes good sense. But if your goal is to maximize your tax deduction, carefully review these steps, consult with your tax adviser and then make your decision.Oct 24, 2017

How do you write off a donated car on taxes?

How much can I deduct? Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price. If your vehicle sells for $500 or less, you can deduct the “fair market value” of your vehicle, up to $500.

Can you write off giving away a car?

The only time you can claim a tax deduction for giving your car away is when you donate it to a charity or other tax-exempt, IRS-qualified organization. If you give the car away to a friend or family member, a tax deduction isn't available. And you may end up owing a gift tax on the transfer.

What is the maximum charitable deduction for a car donated without itemizing?

$500A tax write-off for a car donation is a way that you can a benefit from the non-cash charitable donation of a motor vehicle. In most cases, donated vehicles that sell for less than $500 are able to be claimed at the fair market value up to $500 without filling out any extra paperwork.

Can you take charitable donations without itemizing in 2020?

Even if you don't itemize your taxes, you can still deduct for some charitable donations. You can get a tax break for this year's contributions to nonprofits and charities even if you don't itemize your taxes next year.Dec 28, 2021

What does NPR do with donated cars?

The vehicle will be sold at auction and the proceeds benefit your chosen public radio station. It couldn't be easier, and its just a call or form submission away. Call or click today and donate a vehicle to an NPR station!

Is donating a car considered a gift?

The value of your write-off is equal to the value of your car, as determined by Internal Revenue Service valuation rules. If you donate your car to any party other than a qualified nonprofit organization, however, you enjoy no tax benefits and you may even subject yourself to gift tax liability.

Can you take charitable donations without itemizing in 2021?

When you don't itemize your tax deductions, you typically won't get any additional tax savings from donating to charity. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction.Dec 16, 2021

Who can take educator expense deduction?

You're an eligible educator if, for the tax year you're a kindergarten through grade 12 teacher, instructor, counselor, principal or aide for at least 900 hours a school year in a school that provides elementary or secondary education as determined under state law.Feb 16, 2022

What is the IRA charitable rollover tax benefit?

The IRA charitable rollover allows eligible donors to exclude up to $100,000 per year in IRA gifts from their ordinary taxable income, removing these negative tax consequences.

What is the 2021 standard deduction?

$12,5502021 Standard Deductions The deduction set by the IRS for 2021 is: $12,550 for single filers. $12,550 for married couples filing separately. $18,800 for heads of households.

What is the IRS underpayment penalty for an overstated charitable contribution?

Under the new legislation if the Internal Revenue Service determines that an individual has overstated its charitable tax deductions (or underpaid its tax liability), a penalty of 50% of the individual's total deduction amount may be assessed.Nov 18, 2021

What’s the maximum tax write off for a car donation?

It depends on the car, but most donations fall into three categories: Under $500 Over $500 but less than $5,000 Over $5,000 In order to be eligible...

How much of a tax deduction do you get for donating your car?

According to the IRS, if a charity sells your car for less than $500, you can claim the fair market value for up to a maximum of $500. If the car s...

What is an appraisal, and do I need to do it?

An appraisal is a professional opinion of what something is worth, or what it could get on the market. Kars4Kids does appraisals on real estate so...

Is there a way for me to maximize my tax write-off?

The rules are the same for all car donations to all nonprofits. It’s therefore a good idea to do research into any other benefits the nonprofit mig...

How do I know how much my car sold for, and how does that translate to taxes?

As soon as your car sells, we send you an e-mail receipt for tax purposes. The e-mail will contain all the information you need for documentation,...

How to claim a car donation?

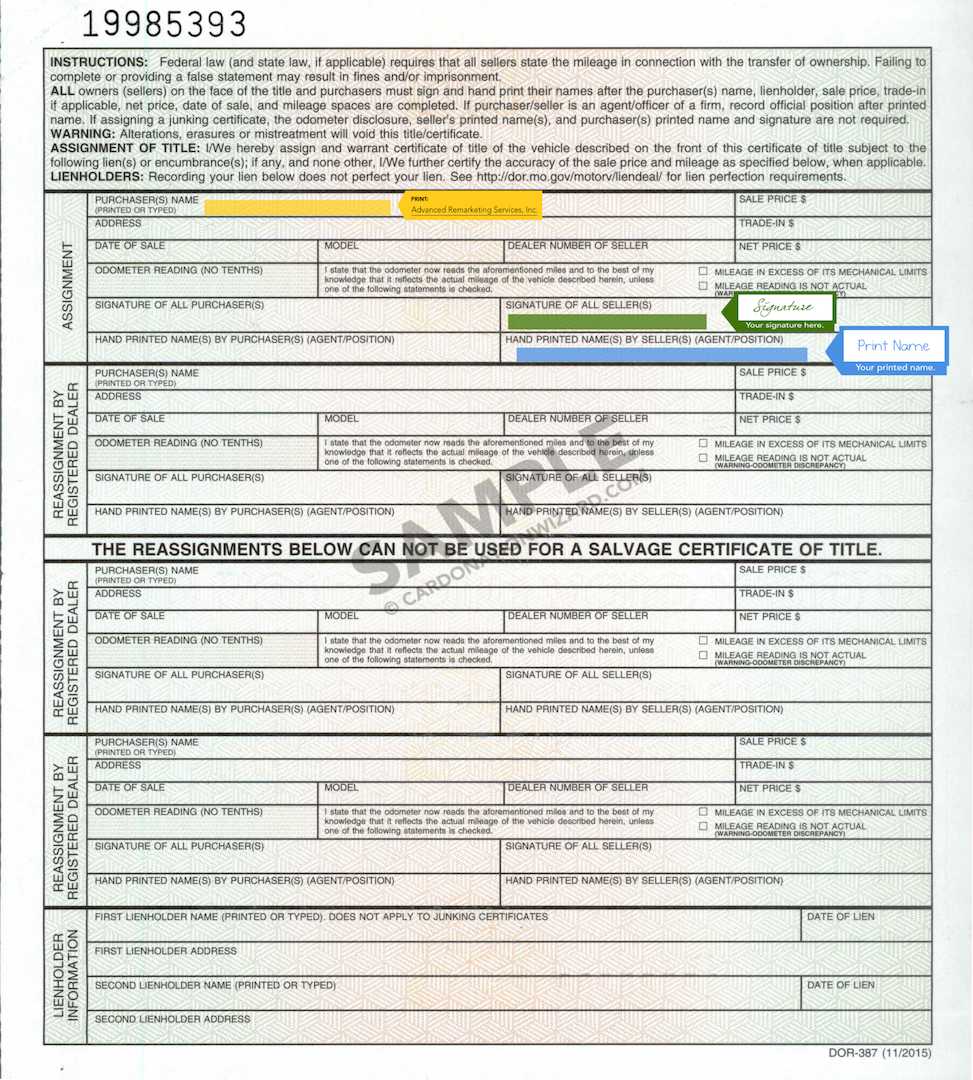

In order to claim a deduction for your donated car, you must have documentation of your donation. At a minimum, the documentation you receive from the charity must include: 1 Your name 2 The vehicle identification number 3 The date of your donation 4 A statement describing any goods and services you received

Can you deduct a car that is sold for $500?

However, if the charity sells the car at a significant discount to a needy individual, or keeps the car for its own internal use, then you can claim a deduction for its fair market value. If the charity sells your car sells for $500 or less, you can deduct $500 or your car’s fair market value, whichever is less.

Can you claim a car donation on Schedule A?

Report the amount of your deduction on Schedule A. Since you can only claim a deduction for your car donation if you itemize, the total of all your eligible expenses on Schedule A must exceed the standard deduction amount for your filing status.

How much can you claim on a car that is less than $500?

IF YOUR CAR SELLS FOR LESS THAN $500: You can claim the fair market value of the car, up to $500. According to the IRS, it is up to you to determine the fair market value of your car.

What is the most important consideration when choosing a charity?

The most important consideration when choosing a charity is determining its "exempt" status. To be eligible for a tax deduction, the car must be donated to a tax-exempt nonprofit organization, most commonly known as a 501 (c) (3) organization.

How much can you deduct from a car donation?

Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price. If your vehicle sells for $500 or less, you can deduct the “fair market value” of your vehicle, up to $500.

What does donating a car do for Habitat?

Proceeds from the sale of your donated vehicle will help Habitat families in the United States build strength, stability and self-reliance. Plus, it’s fast and easy to do, and your donation will qualify for tax deductions. Take a look at our most common tax questions below.

Is Habitat for Humanity a 501c3?

Yes. Habitat for Humanity is a 501 (c) (3) nonprofit organization. Contributions, including vehicle donations, may be claimed as deductions on your federal tax return, if you itemize.

How to choose what charity to give your car to?

There are many non-profits that have automobile donation programs. As with any charitable donation, you will want to select a charity that aligns with your goals and values.

Places to donate old car for tax deduction?

Most national charity thrift stores have programs, along with other non-profit organizations. Here are a few:

Are you ready to donate your old car for a tax write off?

When we told our son that we were going to give our van to Make-A-Wish to grant sick kids wishes, he thought that was super cool and was on board to give his beloved chemo van away. I will always remember, “Goodbye van!”

Popular Posts:

- 1. how to get companies to donate money

- 2. what do you need to donate a car

- 3. how to donate on twitch without paypal

- 4. which of the following is the main reason why individuals donate money to charities quizlet

- 5. where to donate animals to people around the world

- 6. where to donate clothes for homeless near me

- 7. how to donate a youtube channel when not on live stream

- 8. in the bible where does it say a blood donate or save my life

- 9. st vincent de paul what can i donate

- 10. where to donate used bras near me