In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A

IRS tax forms

Internal Revenue Service tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States. They are used to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code. There are over 800 various forms and schedules. Other tax forms in …

What is the maximum tax deduction for donations?

Nov 30, 2021 · Individuals can write off up to $300 in cash donations, up to $600 for couples filing jointly, made to qualifying charities if they take the standard deduction.

How much are we allowed for tax deductible donations?

For the 2020 tax year only, if you made cash gifts to public charities other than supporting organizations or donor-advised funds, then you can deduct up …

Is there a limit to charitable giving for taxes?

Jan 31, 2022 · There is no limit to how much you can claim, however, there is a limit to how much of a donation you can claim in a financial year. A deduction for a gift can reduce your accessible income to nil in a tax year, but it is not allowed to create or add tax loss.

What is the Max donation for taxes?

Mar 15, 2021 · Following special tax law changes made earlier this year, cash donations of up to $300 made before December 31, 2020, are now deductible when people file their taxes in 2021. Under this new change, individual taxpayers can claim an “above-the-line” deduction of up to $300 for cash donations made to charity during 2020.

How much does the IRS allow for charitable donations 2021?

$300However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments.Feb 18, 2022

How much can you donate to get a tax break?

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come ...

How much can you write off for donations 2021?

$300Taxpayers who take the standard deduction can claim a deduction of up to $300 for cash contributions to qualifying charities made in 2021. Married couples filing jointly can claim up to $600.Jan 4, 2022

How much can you claim in charitable donations without receipts 2020?

Following tax law changes, cash donations of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when people file their taxes in 2021.Dec 14, 2020

What is the 30% limit on charitable contributions?

One rule to remember here is that the deduction is limited to 30% of your adjusted gross income (AGI). If you're not able to use the entire donation deduction this year, you can still carry forward unused deductions for five years.Dec 10, 2021

Are church donations tax deductible in 2021?

Limitations on annual church donations However, the amounts you can't deduct this year can be used as a deduction on one of your next five tax returns. For tax years 2020 and 2021, the contribution limit is 100% of your adjusted gross income (AGI) of qualified cash donations to charities.Jan 10, 2022

Do charitable donations have to be itemized?

Yes. If you choose to deduct a charitable donation amount on your tax return, you are required to itemize charitable donations on Form 1040, Schedule A : Itemized Deductions. ” A charitable donation may be considered a monetary donation or the donation of goods, services or merchandise.

How much can you donate to charity for taxes without receipt?

The IRS considers each donation separately. It doesn't matter whether the donation to one organization reaches the $250 limit.

Are All Donations Tax Deductible?

No. The IRS only allows you to deduct donations from your taxable income if the donation was made to a qualified tax-exempt organization. 501(c)(3)...

What Is The Maximum Charitable Donation Limit Per Year?

This is where things get a bit tricky. There are maximum IRS charitable donation amounts, but they are a percentage and not a defined dollar amount...

What If You Donate More Than The IRS Limit? Can You Carry Over Donations to Future years?

Yes. You can carry over deductions from any year in which you surpass the IRS charitable donation deduction limits, up to a maximum of 5 years. The...

What Proof Do You Need to Claim A Charitable Donation?

By default, always at least get written confirmation. I won’t get in to the full details here, since I have previously gone in to depth about cash...

Can You Deduct Charitable Contributions If You Don’T Itemize Your Taxes?

In order to deduct a charitable contribution, you must itemize your taxes. THIS. IS. HUGE.Less than 40% of American taxpayers itemize their taxes,...

The Republican Tax Reform Impact on Charitable Deductions

I wrote about this at length, but the Republican “Tax Cuts and Jobs Act” (aka “Republican tax reform” will create a charitable donation deduction c...

How much can you deduct for charitable donations in 2020?

The amount is $300 for taxpayers in 2020.

What is charitable giving?

Charitable giving is a hallmark of the American spirit. Every year, people give billions of dollars to charitable organizations that then put that money to work helping those in need. Whether you give cash, investment securities, or household items, charities use those resources to reach their goals. The federal government encourages charitable ...

How much is the 2020 tax refund?

The amount is $300 for taxpayers in 2020. For joint filers, the amount rises to $600 in 2021. However, these provisions are set to go away in 2022.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Do you get a tax break for charitable donations?

If the total of your charitable gifts and your other itemized deductions is less than the standard deduction, then you essentially don't really get any extra tax break for your giving. Image source: Getty Images. For the 2020 and 2021 tax years, there's an exception to this rule.

Claiming Tax Deductible Donations

Tax deduction is given for donations made in the preceding year. For example, if an individual makes a donation in 2021, tax deduction will be allowed in his tax assessment for the Year of Assessment 2022.

Federal Tax Deductions For Charitable Donations

You may be able to claim a deduction on your federal taxes if you donated to a 5013 organization. To deduct donations, you must file a Schedule A with your tax form. With proper documentation, you can claim vehicle or cash donations. Or, if you want to deduct a non-cash donation, you’ll also have to fill out Form 8283.

Expenses From Volunteer Efforts Count

While you wont get a deduction for the value of your time or services when volunteering, any purchases made to benefit an organization can be deducted if theyre not reimbursed. Keep a record of items you buy to benefit nonprofits, as well as receipts.

How To Get A Tax Deduction For Donating To Charity

Outside of the special deduction for 2021 described above, if you want to deduct charity donations on your tax return, you’ll need to itemize your deductions. Save a bank record of each payment, such as a canceled check or a bank statement showing your debit, to document your donation.

Can I Deduct Non

Besides cash donations, you can deduct food items, clothes, cars, household goods and other property. Most goods can be deducted for the fair-market value of the items, as long as they’re in good condition. As for vehicles, the deduction for donating a car depends on whether it was auctioned off or kept by the charity.

Common Estimated Donation Values

When making non cash donations, the value of your donation equals its current fair market value. Large ticket or rare items may be hard to value and could require the help of an independent appraiser. If youre claiming that the donated object is worth more than $5,000, note that you must have an appraiser sign-off on your tax form.

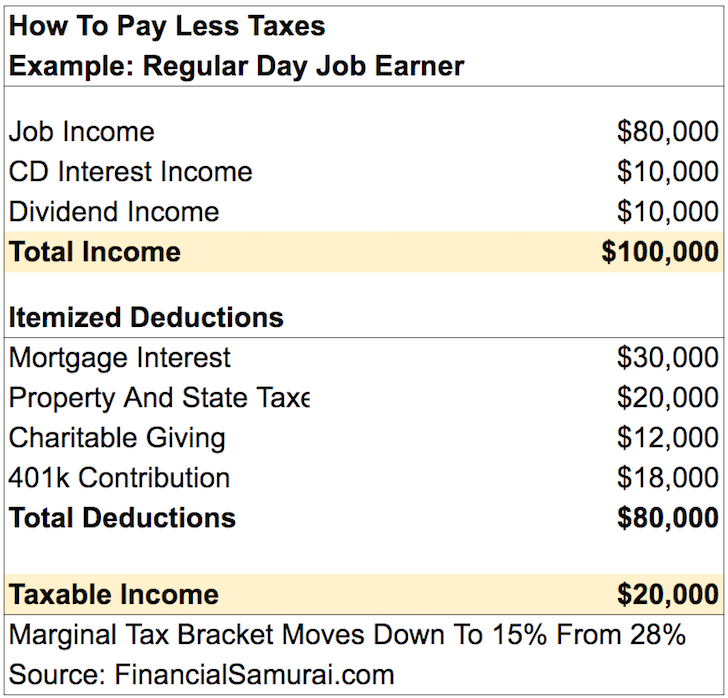

Max Out Your 401 By Dec 31

Contributions to a traditional 401 reduce your total taxable income for the year.

What is tax deductible donation?

Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Tax deductible donations can reduce taxable income. To claim tax deductible donations on your taxes, you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. For the 2020 tax year, there's a twist: you can deduct ...

How to deduct charitable donations?

1. Donate to a qualifying organization 1 Your charitable giving will qualify for a tax deduction only if it goes to a tax-exempt organization, as defined by section 501 (c) (3) of the Internal Revenue Code. Examples of qualified institutions include religious organizations, the Red Cross, nonprofit educational agencies, museums, volunteer fire companies and organizations that maintain public parks. 2 An organization can be nonprofit without 501 (c) (3) status, which can make it tricky to ensure your charity of choice counts. 3 You can verify an organization’s status with the IRS Exempt Organizations Select Check tool. 4 Before you donate, ask the charity how much of your contribution will be tax-deductible.

How much can you deduct on your taxes for 2020?

For the 2020 tax year, you can deduct up to $300 of cash donations on a tax return without having to itemize. This is called an "above the line" deduction.

Can you deduct volunteer time?

IRS rules don’t let you deduct the value of your time or service, but expenses related to volunteering for a qualified organization can be tax deductible donations. Expenses must be directly and solely connected to the volunteer work you did; not previously reimbursed; and not personal, living, or family expenses.

Can you itemize a standard deduction?

Itemizing can take more time than if you just take the standard deduction, and it may require more expensive tax software or create a higher bill from your tax preparer. Plus, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to abandon itemizing and take the standard deduction instead. ...

How much can you deduct from charitable donations?

Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Tax Exempt Organization Search uses deductibility status codes to identify these ...

What percentage of charitable contributions can you deduct on Schedule A?

In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (AGI). Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent ...

What is tax exempt organization search?

The organizations listed in Tax Exempt Organization Search with foreign addresses are generally not foreign organizations but are domestically formed organizations carrying on activities in foreign countries. These organizations are treated the same as any other domestic organization with regard to deductibility limitations.

Can you deduct a donation of cash?

Deductible Amounts. If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made.

What is Revenue Procedure 2011-33?

887 describes the extent to which grantors and contributors may rely on the listing of an organization in electronic Publication 78 and the IRS Business Master File extract) in determining the deductibility of contributions to such organization. Grantors and contributors may continue to rely on the Pub.78 data contained in Tax Exempt Organization Search to the same extent provided for in Revenue Procedure 2011-33.

Can you deduct charitable contributions?

You may deduct a charitable contribution made to, or for the use of, any of the following organizations that otherwise are qualified under section 170 (c) of the Internal Revenue Code:

How much is the 2020 tax deduction?

The 2020 standard deduction is set at $24,800 for joint returns and $12,400 for unmarried individuals, with an added $1,300 for each married individual over age 65 or blind, or $1,650 for unmarried individuals . State and local tax deductions are capped at $10,000 ($5,000 if married and filing separately). 5.

What is the charitable contribution ceiling for 2020?

For 2020, the ceiling on deduction for charitable contributions of cash is increased. Previously, the deduction for cash contributions to qualifying organizations was limited to 60% of an individual taxpayer’s contribution base, which is generally equal to a taxpayer’s adjusted gross income, or AGI (calculated without any net operating loss carrybacks). For this one year, taxpayers may deduct the amount of their cash charitable contributions in excess of their allowable noncash charitable contributions, up to the full amount of their AGI. This higher ceiling will enable some taxpayers to eliminate all of their taxable income. If a taxpayer’s contributions exceed the ceiling, then the unused amount may be carried forward for up to five years.

What is tax exempt status?

Therefore, a recipient must qualify for tax-exempt status as required by the tax code and determined by the Internal Revenue Service (IRS) .

Is charitable contribution tax exempt?

The tax treatment of a charitable contribution varies according to the type of contributed asset and the tax-exempt status of the recipient organization. Rules differ for individual, business and corporate donors. Also, the amount of the deduction is subject to standards and ceilings. For the 2020 tax year, special temporary rules increase allowable deductions and thereby the tax benefits for charitable gifts made in cash. Here’s an outline of the rules for deducting charitable contributions, including the more generous allowances for 2020.

Is $300 a standard deduction?

The above-the-line deduction of $300 will benefit many taxpayers who do not itemize. Because of the present high levels for the standard deduction and the ceiling on state and local tax deductions, many taxpayers realize greater tax savings by claiming the standard deduction rather than itemizing.

Do you have to keep a written record for charitable deductions?

Taxpayers must keep detailed records to support their charitable deductions. To claim a deduction for cash, you must have a written record, canceled check, or bank/payroll debit. Every contribution of more than $250 in cash or property must be backed by a written acknowledgment from the donee stating the amount of the contribution, whether or not any goods or services were provided to the contributor, and the fair market value of any such goods or services. Significant property contributions also require appraisals. 13

Can you deduct charitable donations?

The Charitable Contributions Deduction allows taxpayers to deduct contributions of cash and property to charitable organizations, subject to certain limitations. For a charitable contribution to be deductible, the recipient charity must be a qualified organization under the tax law. Annual caps limit the total amount of charitable contribution ...

What is a 8282 form?

Form 8282 is used to report information to the IRS and donors about dispositions of certain charitable deduction property made within 3 years after the donor contributed the property. Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition, only on the date of the donation. .

What is fair market value?

Fair market value is the price a willing buyer would pay for them. Value usually depends on the condition of the item.

How to deduct a charitable donation?

Once you've decided to give to charity, consider these steps if you plan to take your charitable deduction: 1 Make sure the non-profit organization is a 501 (c) (3) public charity or private foundation. 2 Keep a record of the contribution (usually the tax receipt from the charity). 3 If it's a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you're claiming. 4 With your paperwork ready, itemize your deductions and file your tax return.

How much can you deduct from your charitable contribution in 2021?

When you make a charitable contribution of cash to a qualifying public charity, in 2021, under the Consolidated Appropriations Act 1, you can deduct up to 100% of your adjusted gross income.

Does Fidelity give warranties?

Fidelity Charitable makes no warranties with regard to such information or results obtained by its use. Fidelity Charitable disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

What is the federal tax bracket?

Federal tax brackets are based on taxable income and filing status. Each taxpayer belongs to a designated tax bracket, but it’s a tiered system. For example, a portion of your income is taxed at 12%, the next portion is taxed at 22%, and so on. This is referred to as the marginal tax rate, meaning the percentage of tax applied to your income ...

Can you reduce your tax bill if you itemize?

Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally you'd itemize when the combined total of your anticipated deductions—including charitable gifts—add up to more than the standard deduction.

What is marginal tax rate?

In essence, the marginal tax rate is the percentage taken from your next dollar of taxable income above a pre-defined income threshold. That means each taxpayer is technically in several income tax brackets, but the term “tax bracket” refers to your top tax rate.

Is a non profit a 501c3?

Make sure the non-profit organization is a 501 (c) (3) public charity or private foundation. Keep a record of the contribution (usually the tax receipt from the charity). If it's a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you're claiming.

Are donations to Goodwill tax deductible in 2019?

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

How much can I claim for donations to Goodwill without a receipts?

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.

How much can I write off for clothing donations?

The tax laws say that you can deduct charitable contributions worth up to 60% of your AGI.

How much can I claim for donations?

As long as your donation is $2 or more, and you make it to a deductible gift recipient charity, you can claim the full amount of money that you donated on your tax return.

What is the max donation for taxes 2020?

For the 2020 tax year, you can deduct up to $300 of cash donations on a tax return without having to itemize.

How much charitable donations will trigger an audit?

Donating non-cash items to a charity will raise an audit flag if the value exceeds the $500 threshold for Form 8283, which the IRS always puts under close scrutiny. If you fail to value the donated item correctly, the IRS may deny your entire deduction, even if you underestimate the value.

Is it worth claiming charitable donations?

Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally you’d itemize when the combined total of your anticipated deductions—including charitable gifts—add up to more than the standard deduction.

Temporary Suspension of Limits on Charitable Contributions

- In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (AGI). Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent of their...

Temporary Increase in Limits on Contributions of Food Inventory

- There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the taxpayer’s aggregate net income or taxable income. For contributions of food inv…

Qualified Organizations

- You may deduct a charitable contribution made to, or for the use of, any of the following organizations that otherwise are qualified under section 170(c) of the Internal Revenue Code: 1. A state or United States possession (or political subdivision thereof), or the United States or the District of Columbia, if made exclusively for public purposes; 2. A community chest, corporation…

Timing of Contributions

- Contributions must actually be paid in cash or other property before the close of your tax year to be deductible, whether you use the cash or accrual method.

Deductible Amounts

- If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, some adjustments may have to be made. The rules relating to how to determine fair market value are discussed in Publication 561, Determining the Value of Donated Property PDF.

Limitations on Deductions

- In general, contributions to charitable organizations may be deducted up to 50 percent of adjusted gross income computed without regard to net operating loss carrybacks. Contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (computed without regard to net operating loss car…

Foreign Organizations

- The organizations listed in Tax Exempt Organization Search with foreign addresses are generally not foreign organizationsbut are domestically formed organizations carrying on activities in foreign countries. These organizations are treated the same as any other domestic organization with regard to deductibility limitations. Certain organizations with Canadian addresses listed ma…

Reliance on Tax Exempt Organization Search

- Revenue Procedure 2011-33, 2011-25 I.R.B. 887 describes the extent to which grantors and contributors may rely on the listing of an organization in electronic Publication 78 and the IRS Business Master File extract) in determining the deductibility of contributions to such organization. Grantors and contributors may continue to rely on the Pub.78 data contained in Ta…

Popular Posts:

- 1. where can i donate unused diapers near me

- 2. how to get pulse down to donate plasma

- 3. what if i can't donate on my regular day at octapharma

- 4. how to donate chaitlift in ma

- 5. toys for tots what to donate

- 6. where to donate blood with covid antibodies

- 7. how much did trump donate to harvey victims

- 8. where to donate clothes portland

- 9. where to donate for hurricane laura

- 10. how tto put a donate button on your twitch account with google wallet